Financial Analysis- Income Statement

This article is Part 2 in a 4-Part Series.

- Part 1 - Financial Analysis - Balance Sheet

- Part 2 - This Article

- Part 3 - Financial Analysis- Cash Flow Statement

- Part 4 - Financial Analysis- Ratio Analysis

An Income statement presents information on the financial results of a company’s business activities over a period of time. It is also called Statement of Operations or Statements of Earnings.

Table of Content

- Income Statement

Income Statement

The income statement summarizes sales revenue and expenses for a period of time. Its important to know that Income statement is an estimation of these figures. Some items, such as depreciation expenses are arbitrary.

The Basic equation underlying income statement is :

- Net Income/Net Profit = Revenue - Expense

We will look at the ‘Income statement’ for PI Industries . PI is a leading Agri Input and Custom Synthesis & Manufacturing company in India. The annual report referred is for FY2016. You can see the Annual report here.

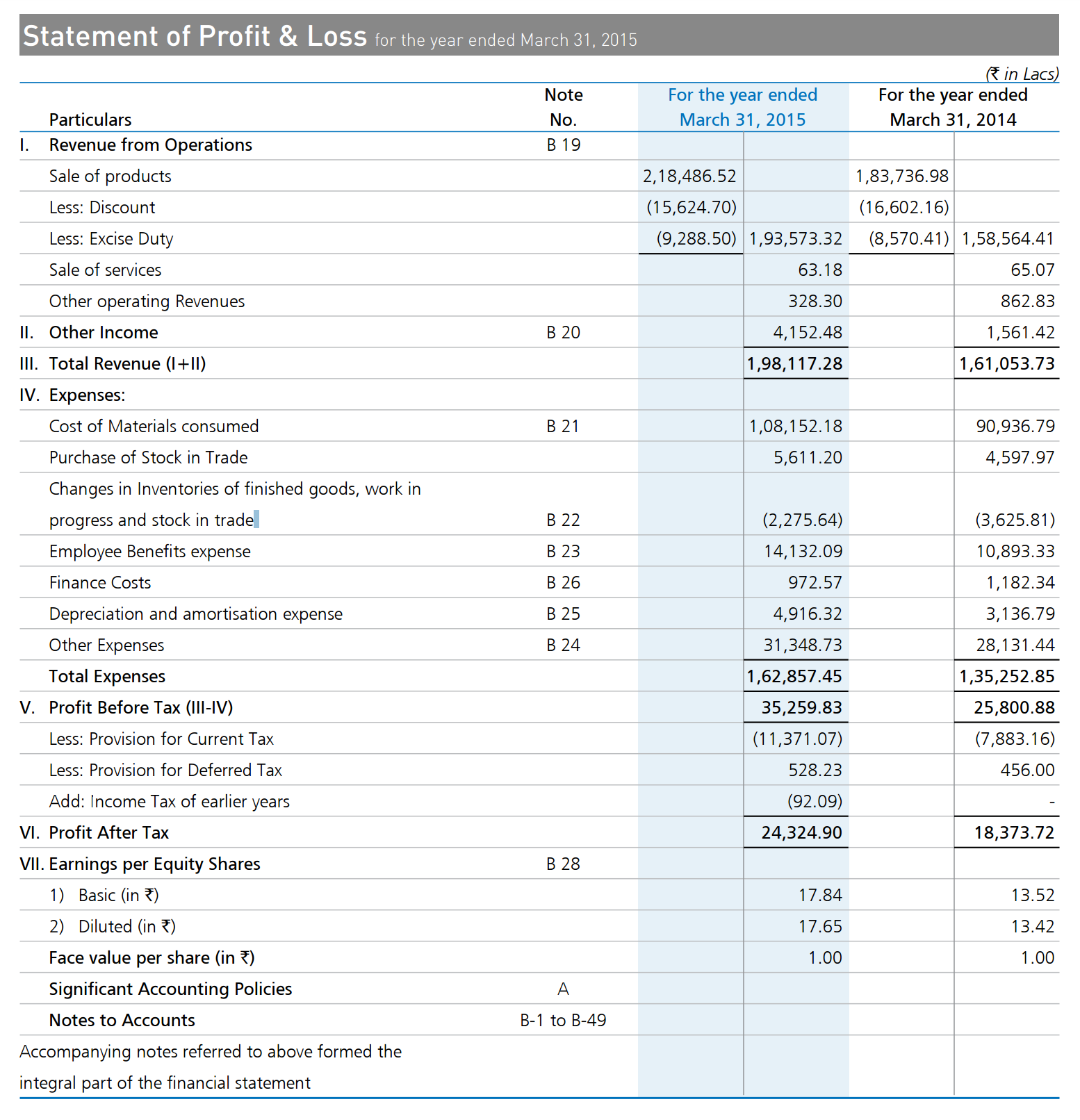

Income Statement for P.I Industries

Next, we will break down the various components of the Income Statement.

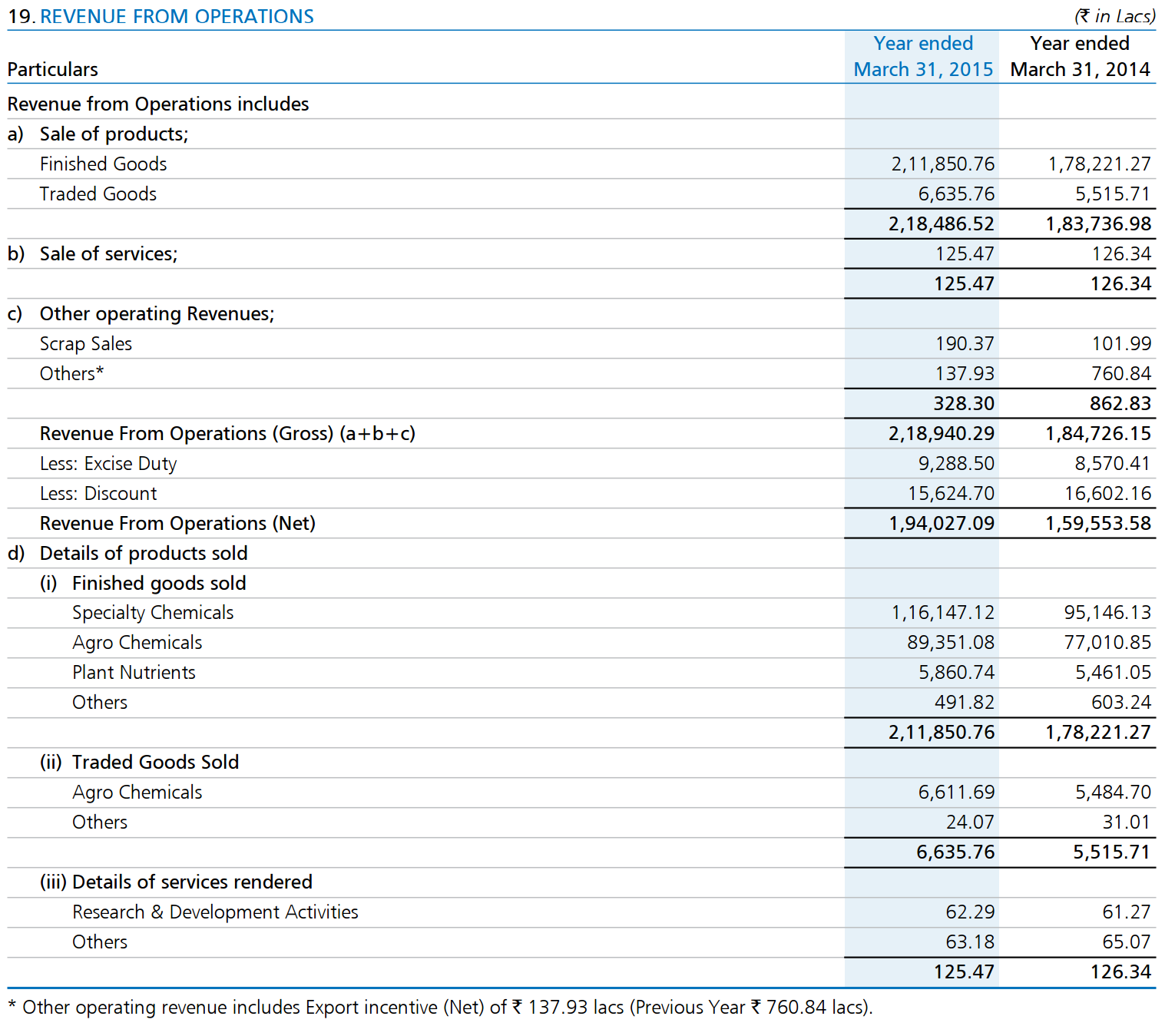

Revenue from Operations

Sales Revenue or Revenue from Operations is the total amount received or to be received from the sales of products (or services) to customers during the period. Sales revenue are net, which means that any discounts provided by company are deducted to determine the sales revenue amount for the period.

The below image illustrates the revenue or income earned by PI industries from its core business selling and trading goods related to Agro chemicals. Apart from that, company also earned money by providing services.

Revenue from Operations

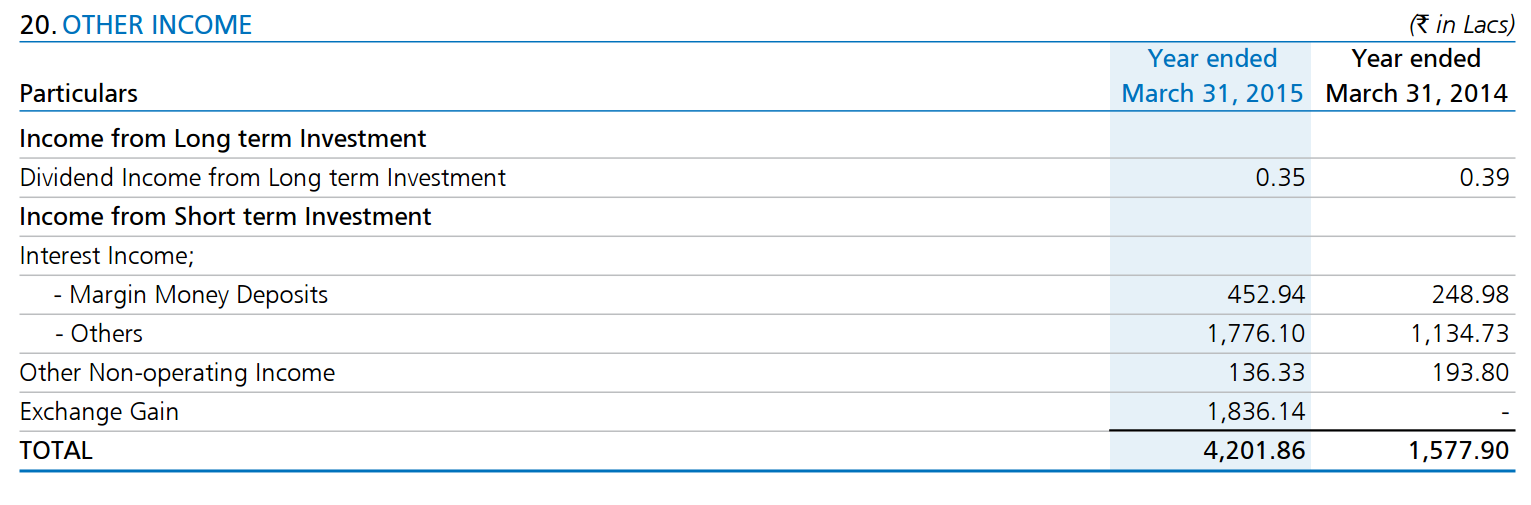

Other Income

This includes all income the company has earned from sources other than its business. This includes interest income on bank deposits and other investments, and dividend income. When a company sells an investment during the year, any gain or loss from the sale of such an investment is also recorded in Other income.

We can see PI Industries note on Other income below:

Expenses

Expenses are the money, a company spends to operate its business. There are various types of expenses.

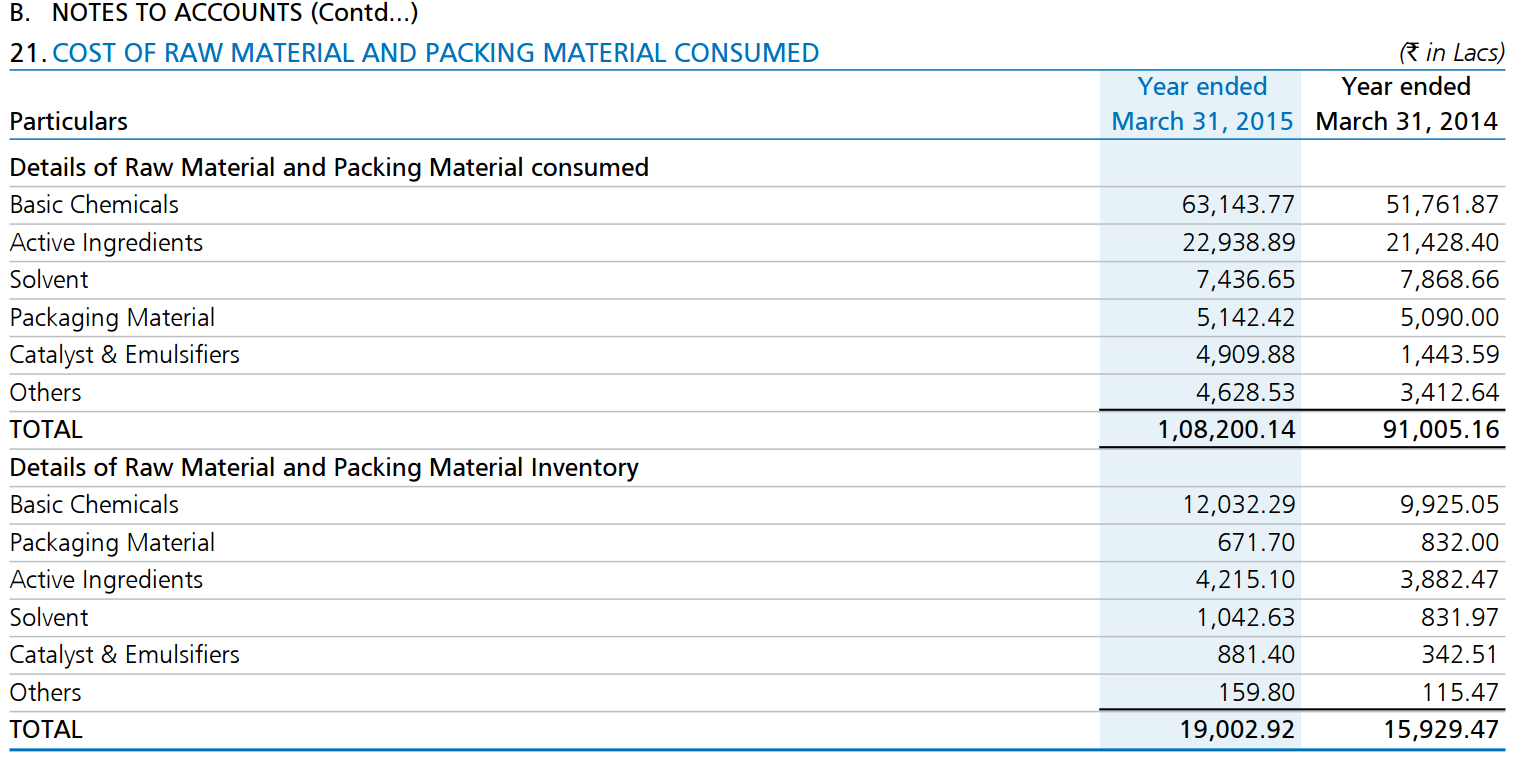

Costs of material consumed

This represents the cost the company incurred during the year to purchase raw materials

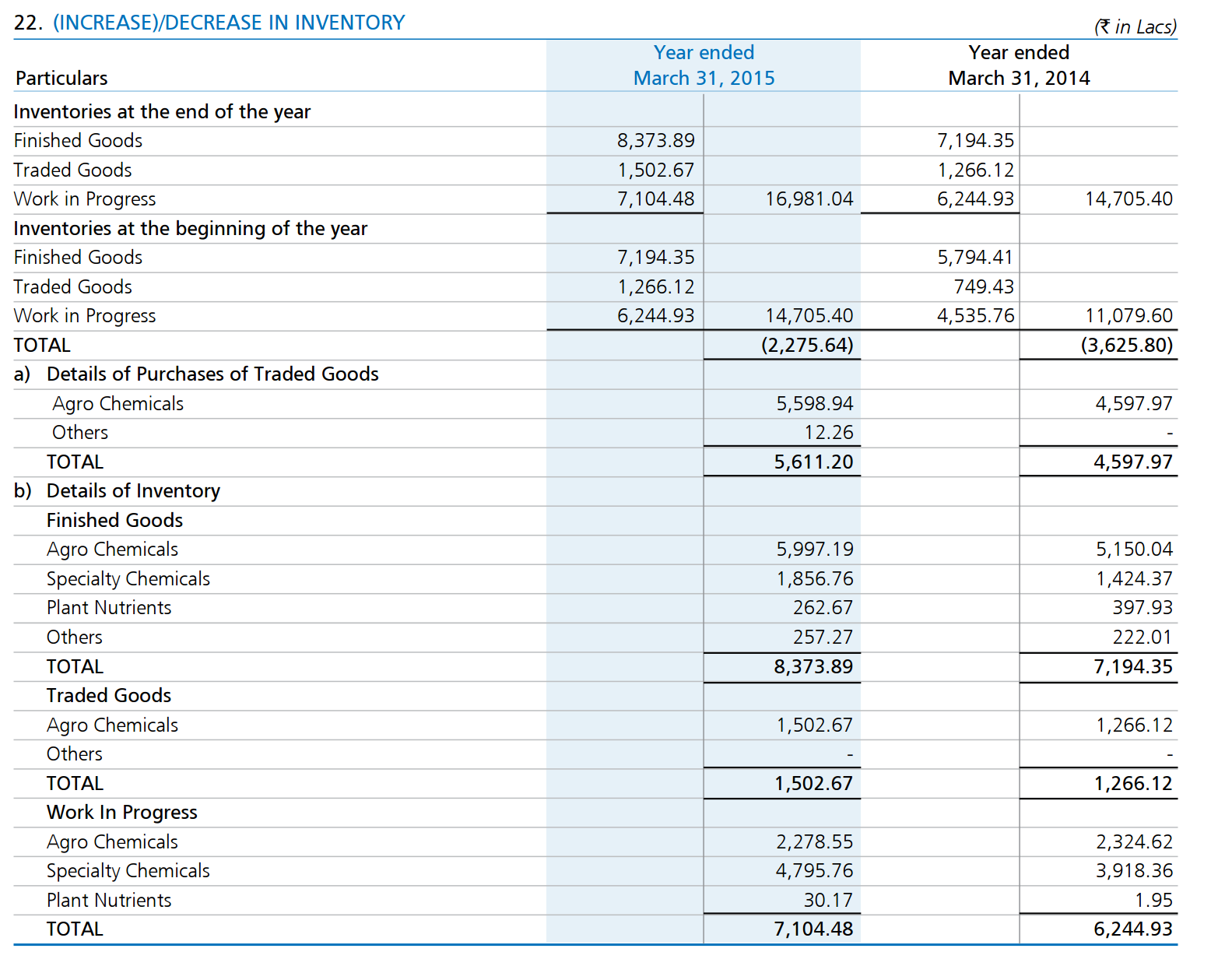

Change in inventory of finished goods and Work in progress

This represents the cost incurred in manufacturing finished and semi-finished goods in part or future period.

As we can see from the notes, the two biggest expenses were the Basic Chemicals and Active Ingredients.

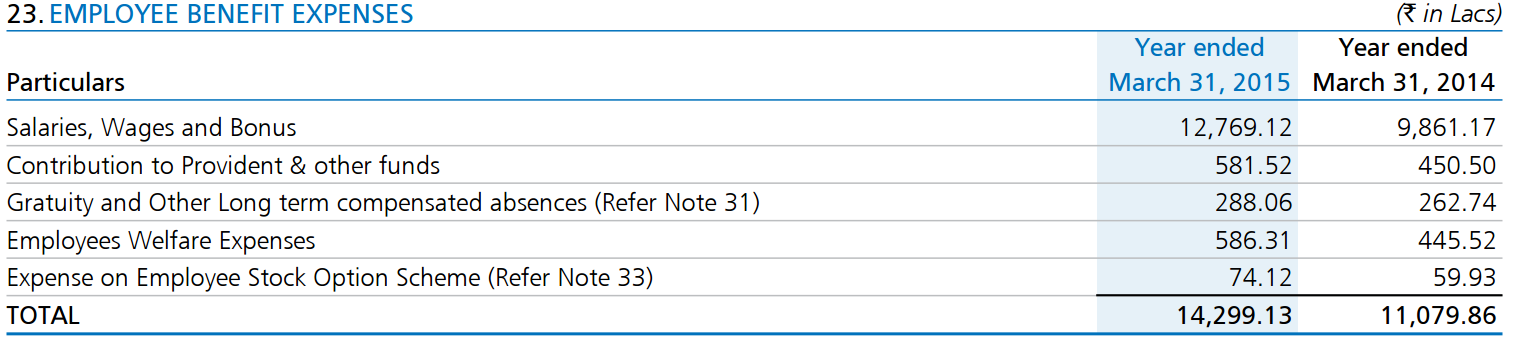

Employee Benefit Expenses

These represent the expenses incurred on the company’s employees during the year, including the salaries and wages paid, contribution to gratuity funds and other employee welfare expenses.

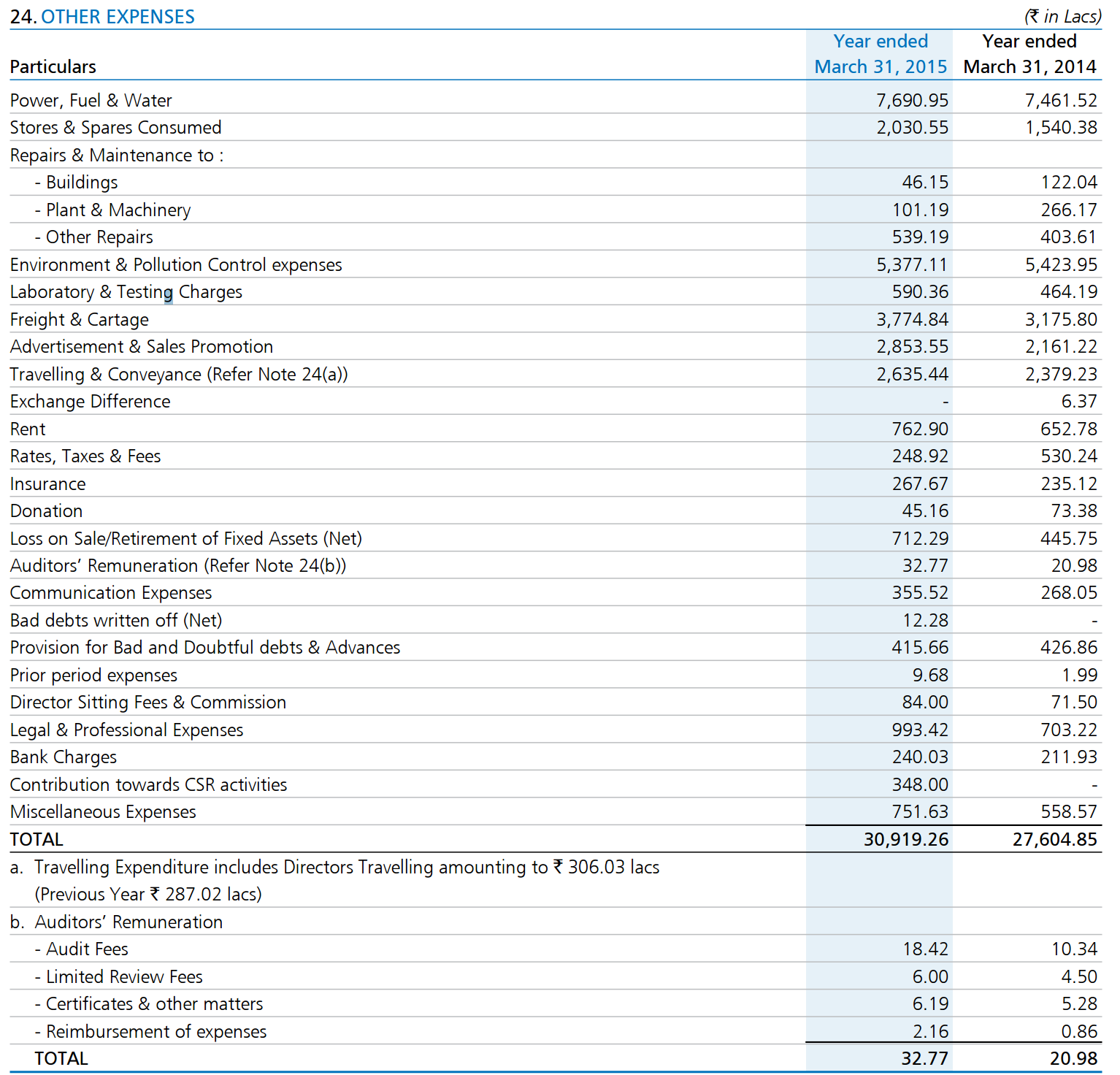

Finance costs

These includes the interest a company pays on borrowings.

As we see, this company pays interest on fixed loans and other related to working capital.

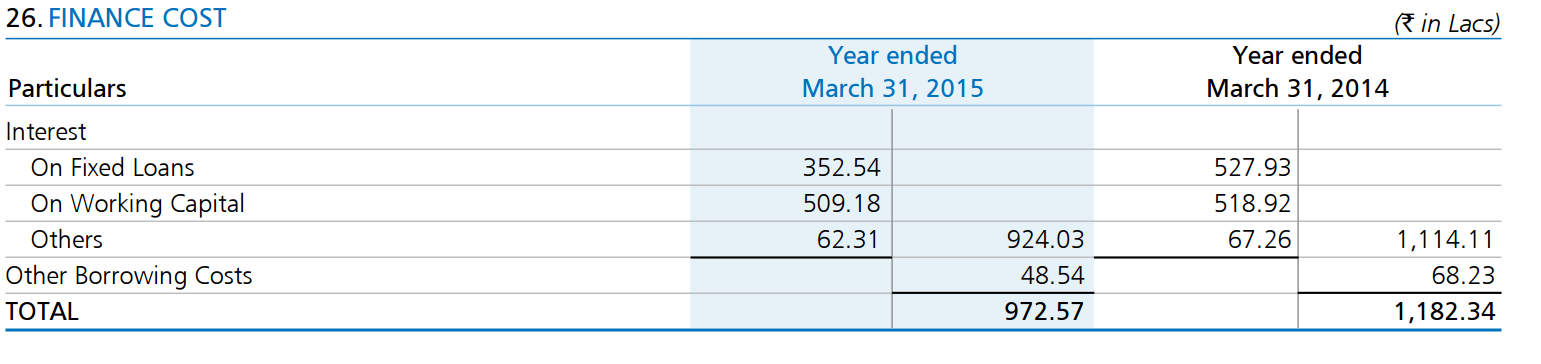

Other expenses

Broadly speaking, every expense other than cost of good sold, interest, and income tax. This broad category is a catch-all for for every expense not reported separately. These include all the other operating expenses that are not meaningful enough for the company to require a separate head.

As we can see from the note, we can see the major expenses for PI industries are ‘Power, Fuel and Water’ , ‘Environment & Pollution Control Expenses’, ‘Freight & Cartage’.

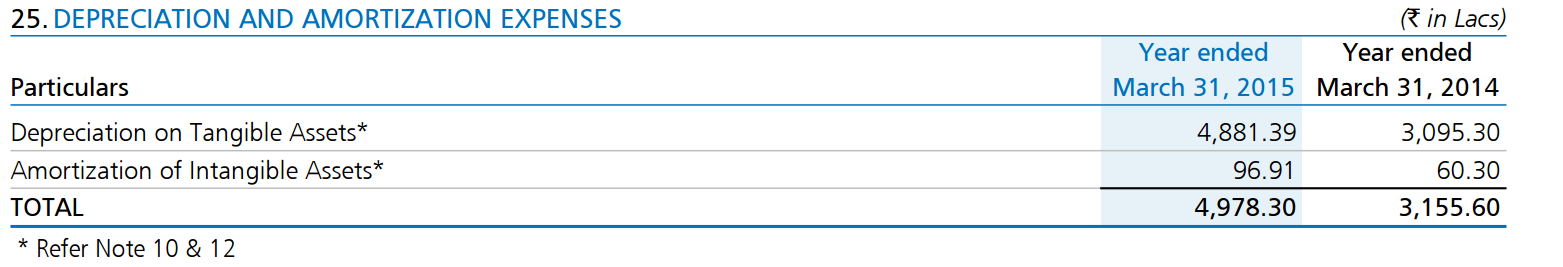

Depreciation and Amortization Expenses

The portions of original costs of long-term assets including buildings, machinery, equipment, tools, furniture, computers, and vehicles that is recorded to expense in one period. Depreciation is the “charge” for using these so-called fixed assets during the period. None of this expense amount is a cash outlay in the period recorded, which makes it unique expense compared with other operating expenses.

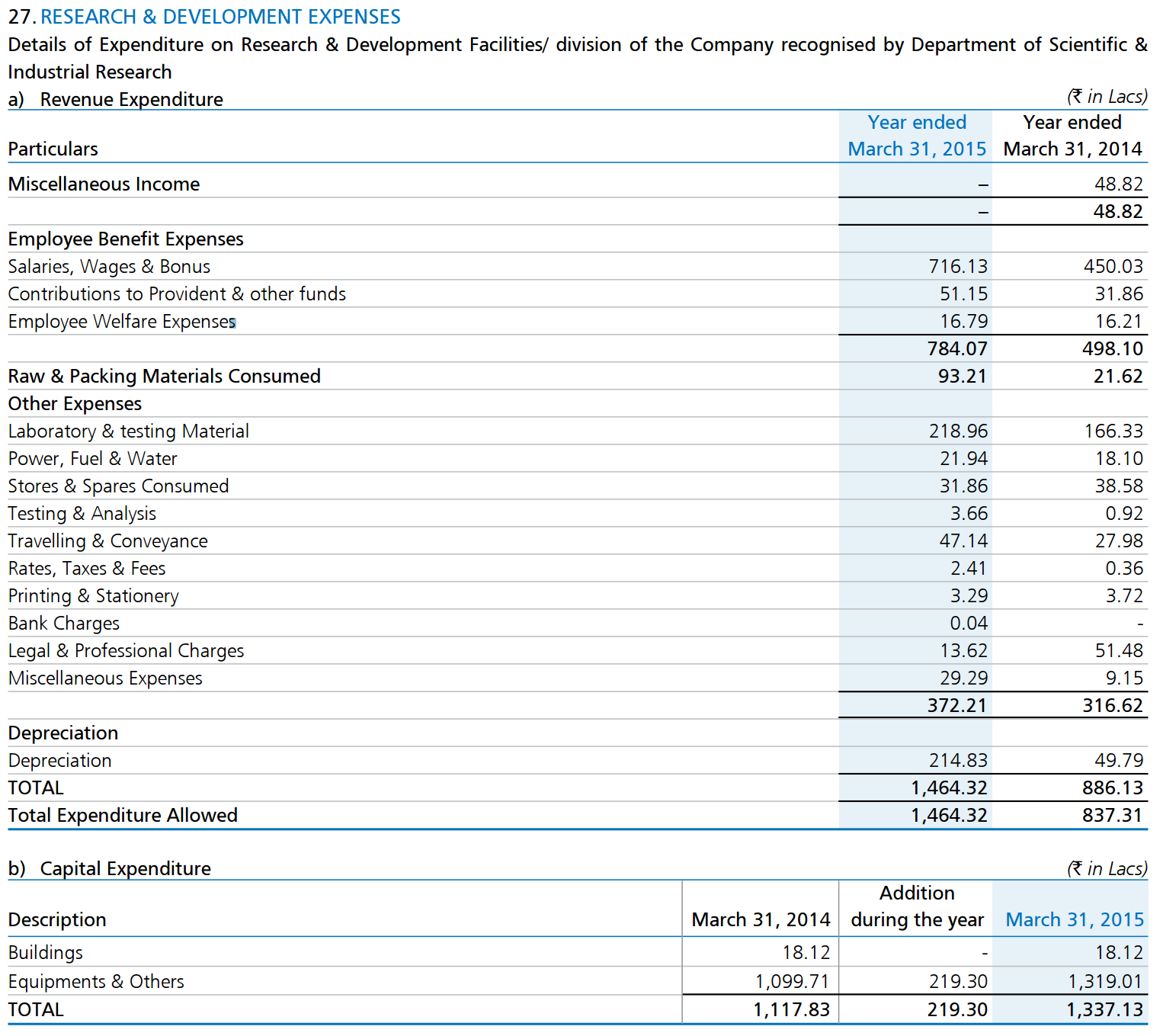

Research and Development (R&D) Expenses

As the name suggest, these are expenses related to the R&D development done by the company.

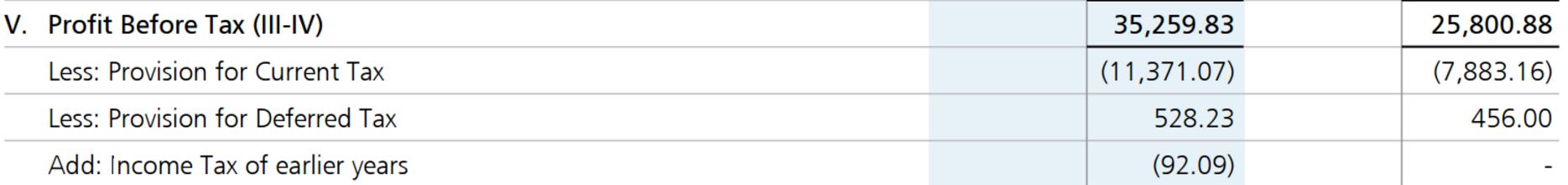

Profit before Tax (PBT)

This is the profit company generates every year (or quarter) before paying income tax to the government. Its calculated as : PBT = Revenue from Operations + Other Income - Expenses

Below we can see the PBT calculation for PI.

Tax Expenses

The amount due to the government on the amount of taxable income of the business during the period. This also includes other taxes as we can see below

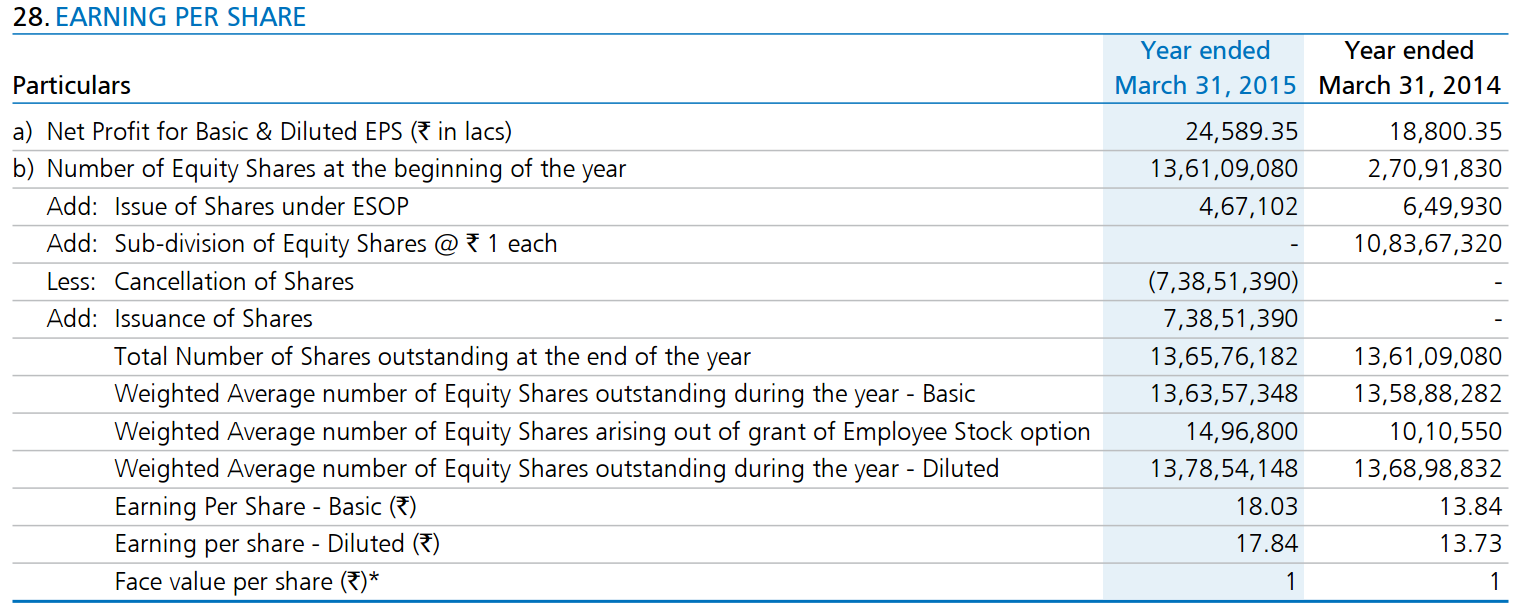

Net Profit and EPS

Net Profit is the result of PBT minus Tax, and EPS can be calculated by dividing Net Profit by No. of shares outstanding. THe EPS figure is mentioned in the Income Statement.

Minority Interest and Share of Profit of Associates

These items lie in the account of companies that either have subsidiaries (where they own a majority stake) or associates (where they own a minority stake).

- Minority Interest is the profit that belongs to minority shareholders in a company that is majority owned by a company.

- Share of Profit of Associates is the company’s share of profit in companies where it has minority stakes.

Leave a Comment