Financial Analysis- Cash Flow Statement

This article is Part 3 in a 4-Part Series.

- Part 1 - Financial Analysis - Balance Sheet

- Part 2 - Financial Analysis- Income Statement

- Part 3 - This Article

- Part 4 - Financial Analysis- Ratio Analysis

Table of Content

Cash Flow Statement

Cash Flow Statement is probably the most important financial statement. Cash flow statement provides information about cash generated in operating activities. It also provides information about cash provided (or used) in a company’s investing and financial activities.

Cash flow statement information also allows an user to answer questions such as :

- Does the company generate enough cash from its operation to pay for its new investments, or is the company relying on new borrowings to finance them.

- Does the company pay its dividends to common stockholders using cash generated from operations, selling assets or issuing debt?

Cash Flow Statement Composition

All companies engage in operating, investing, and financing activities. The CFS showcases cash flows as per following three sections.

- Cash Flow from Operating Activities

- Cash Flow from Investing Activities

- Cash Flow from Financing Activities

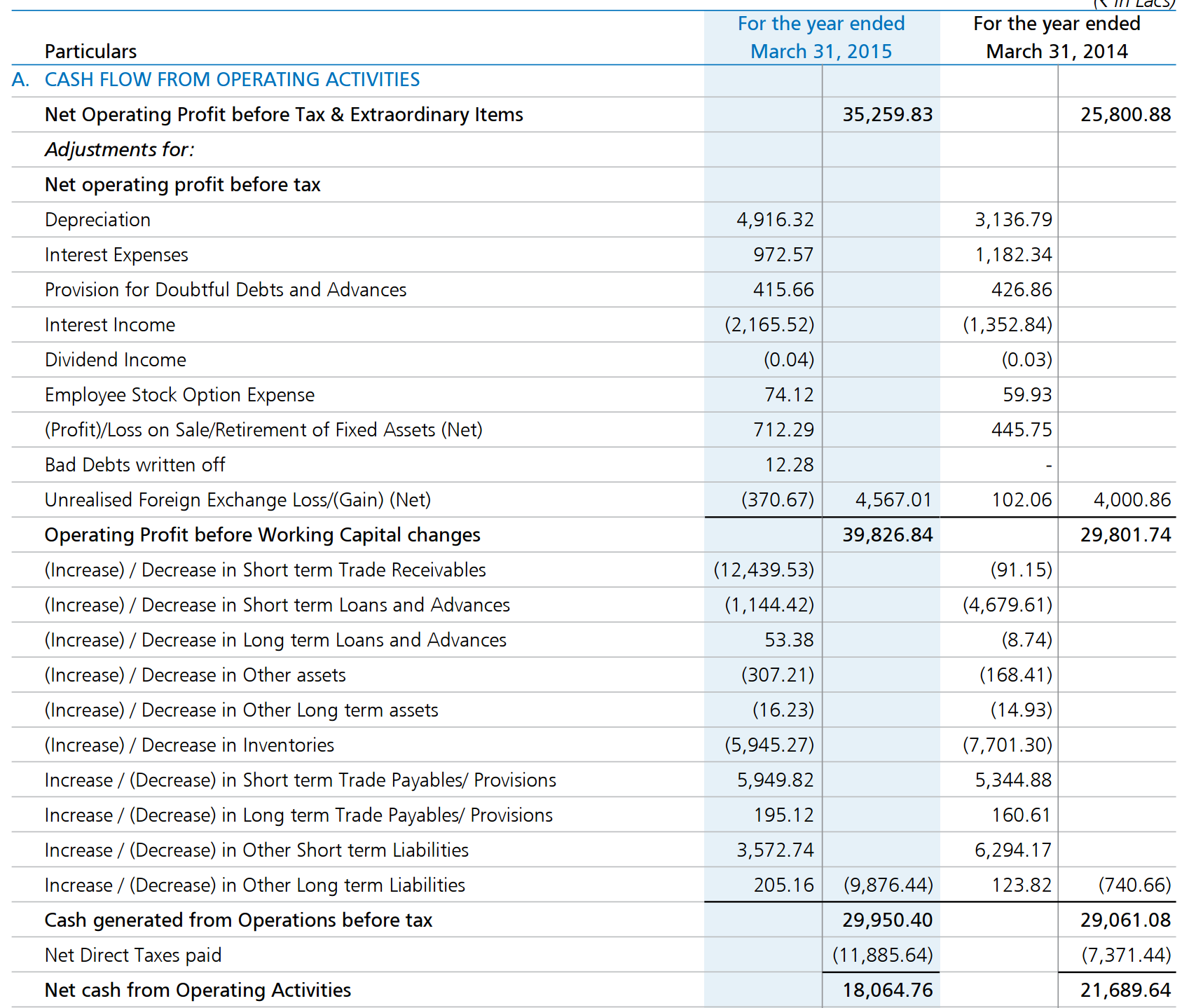

Cash Flow from Operating Activities

This section details cash that a company generates or consumes from its core operating activities, which include the company’s day to day activities that generate revenue, such as selling inventory or providing services.

- Cash inflows result from cash sales and from collection of trade receivables.

- Cash outflows result from cash payments for inventory, salaries, taxes, and other operating related expenses and from paying account payable.

Pointers from Operating Cash flow

Some key questions to ask are :

- What are the major determinants of operating cash flow?

- Is operating cash flow higher or lower than net income? Why?

- How consistent are operating cash flows?

Cash Flow from Investing Activities

-

This section is concerned with the cash a company generates or uses when it invests. A company can use its cash to purchase investments such as debt securities from other companies or government or even shares of other publicly traded companies.

-

This section importantly records the amount of cash that a company as spent in investing into its own business, either for growth or to maintain its current competitive market position.

- These include purchasing and selling tangible assets like property, and plant and equipment, intangible assets, and other long term assets that would help the business grow.

Pointers from Investing Cash flow

This sections tell us how much cash is being :

- Invested for the future in property, plant, and equipment

- Used to acquire entire companies

- Put aside in liquid investment, such as stocks and bonds.

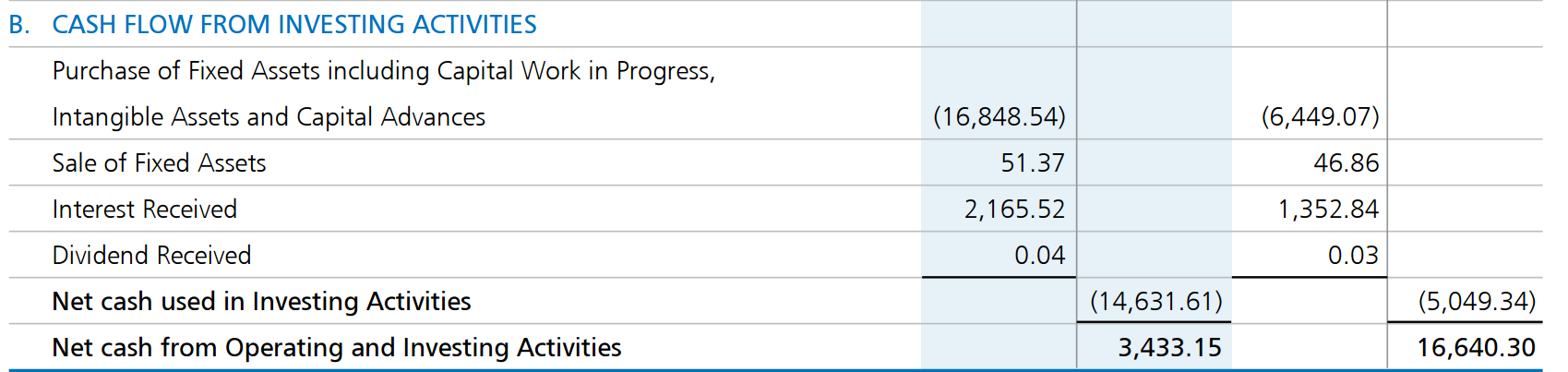

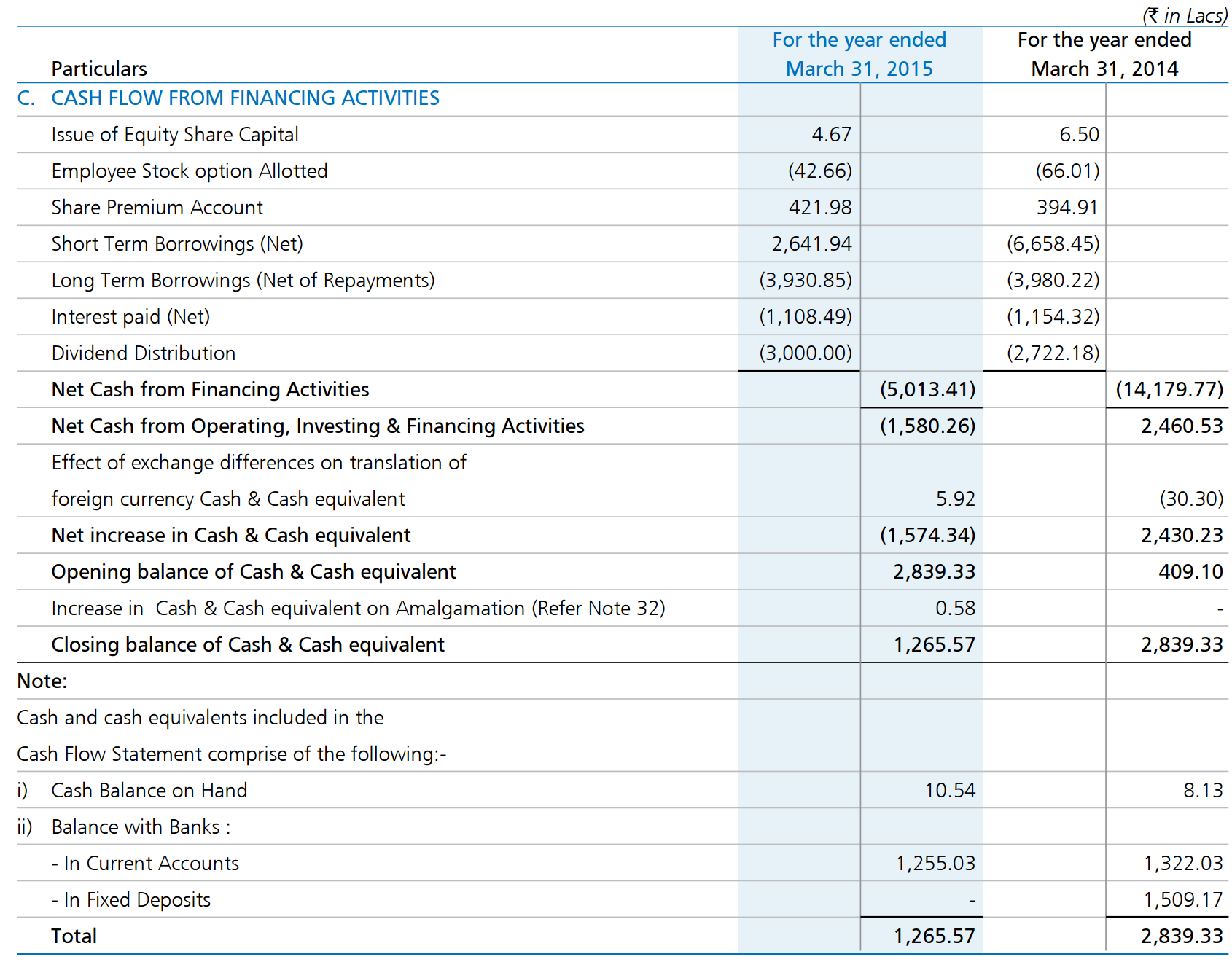

Cash Flow from Financing Activities

This section is about the cash inflows/outflows that result from financing activities which broadly include obtaining or replaying capital such as equity or long term debt.

The two primary sources of capital are :

- Shareholders

- Creditors

Cash inflows include cash receipts from issuing stocks (common or preferred) or bonds and cash receipts from borrowing. Cash outflows include cash payments to purchase stock, to pay dividends, and to repay bonds and other borrowings.

Pointers from Financing cash flow

- Understand whether the company is raising capital or repaying capital and what the nature of its capital sources are.

- If company is borrowing each year, you should consider when repayment may be required.

- Look at How cash flows from operating activities change with time. Ideally it should grow steadily with time.

- Ideally, A company should generate bulk of its cash needs from operating activities and not financing activities

Evaluating Sources and Uses of Cash

Evaluation of CFS should involve an overall assessment of the sources and uses of cash between the three main categories as well as an assessment of the main drivers fo cash flow within each category

The major sources of cash for a company can vary with its stage of growth. * For a mature company, it is desirable to have the primary sources of cash be operating activities. * Over long term, a company must generate cash from its operating activities.

- If operating cash flow are consistently negative, a company would need need to borrow money or issue stock (financing activities) to fund the shortfall.

- Cash generated from operating activities can either be used in investing or financing activities.

- If company has good opportunities to grow the business or other investment opportunities, it is desirable to use the cash in investing activities.

- If company does not have profitable investment opportunities, the cash should be returned to capital providers.

- For new or growth stage company, operating cash flow may be negative for some period of time as it invests in inventories and receivables. But this cannot sustain over the long term.

Some key questions to ask are :

- What are the major sources and uses of cash flow?

- Is operating cash flow positive and sufficient to cover capital expenditures?

Free Cash Flow

Free Cash flow is the excess of operating cash flow over capital expenditures. Free Cash Flow = Operating Cash Flow - Capital Expenditures

There can be two precise free cash flow measures

-

Free Cash Flow to the Firm (FCFF)

FCFF is the cash flow available to the company’s suppliers of debt and equity capital after all operating expenses (including income taxes) and fixed capital have been made.

FCFF = Net Cash from Operating Activities - Net Capital Expenditure = Net Cash from Operating Activities - (Purchase of Fixed Assets- Sale of Fixed Assets) -

Free Cash Flow to Equity (FCFE)

FCFE is the cash flow available to the company’s common stockholders after all operating expenses and borrowing costs (principal and interest) have been paid and necessary investments in working capital and fixed capital have been made.

FCFE = Net Cash From Operating Activities - Net Capital Expenditure + Net Borrowing - Net Debt repayment

Leave a Comment