Financial Analysis - Balance Sheet

Financial statement analysis is a process of understanding the risk and profitability of a company by analyzing reported financial info, especially annual and quarterly reports.

The most important benefit of financial statement analysis is that it provides an idea to the investors about deciding on investing their funds in a particular company.

Identifying great companies requires an understanding of accounting and the ability to read and interpret the basic financial statements: the income statement, balance sheet and cash flow statement. Analyzing, tracking and comparing key numbers from these statements provides the clues that can help us identify great companies.

Accounting is the language of business. Warren Buffett

This article is Part 1 in a 4-Part Series.

- Part 1 - This Article

- Part 2 - Financial Analysis- Income Statement

- Part 3 - Financial Analysis- Cash Flow Statement

- Part 4 - Financial Analysis- Ratio Analysis

Table of Content

- Balance Sheet Analysis

- Some pointers on Balance Sheet

In this article series, We will cover following items:

- Balance Sheet Analysis

- Income Statement Analysis

- Cash Flow statement Analysis

- Ratio Analysis

- Financial Manipulations

Let’s start with the Balance Sheet Analysis

Balance Sheet Analysis

In simple terms, balance sheet discloses what a business owns and what it owes at a specific point in time. Balance Sheet tells about a company’s liquidity, financial strength and efficiency.

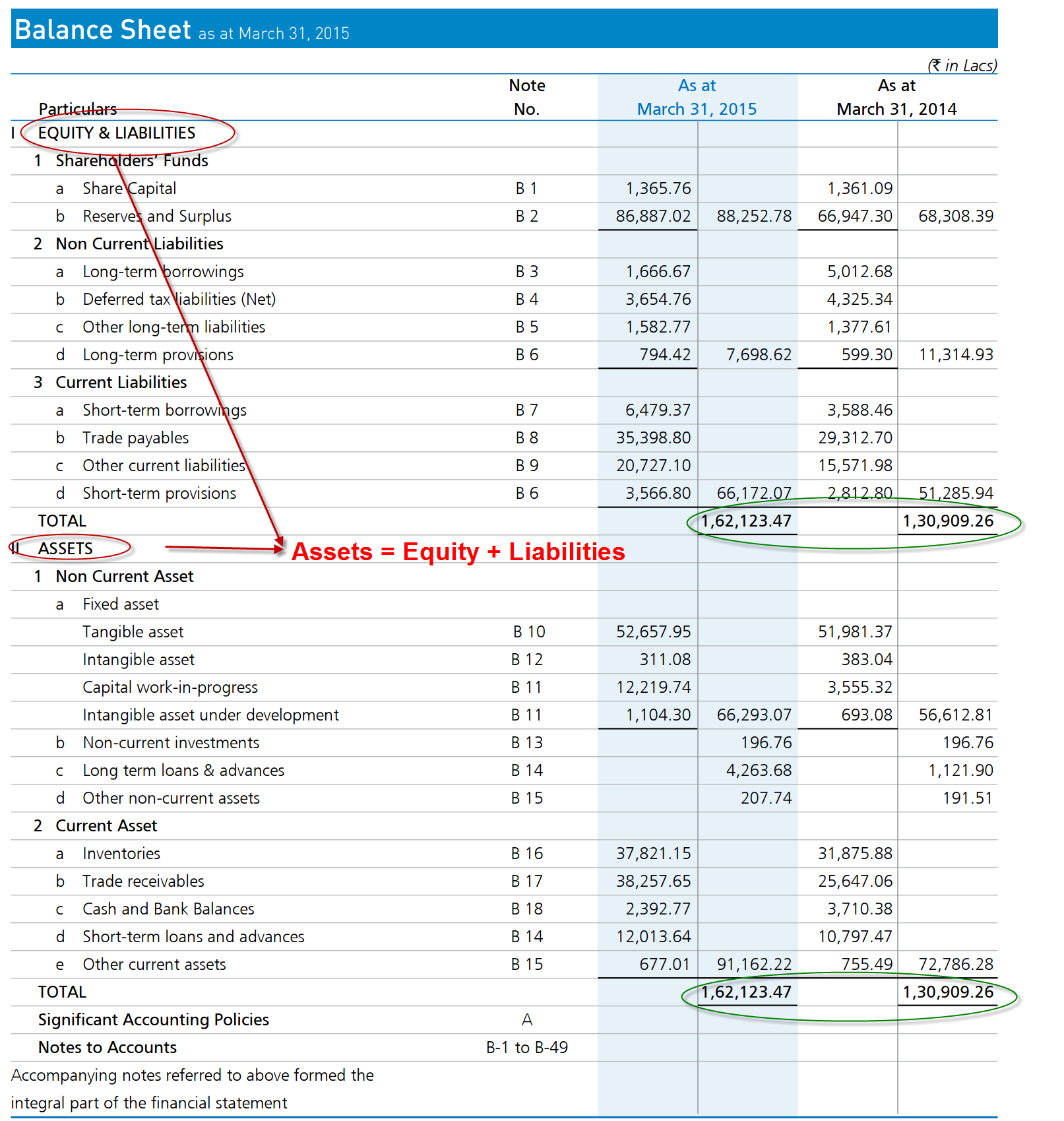

Assets=Liabilities + Equity

We will look at the ‘Balance Sheet’ for PI Industries . PI is a leading Agri Input and Custom Synthesis & Manufacturing company in India. The annual report referred for this post is for FY2016. You can find the Annual report here.

Balance Sheet for P.I Industries

As we see, Assets=Liabilities + Equity has to be satisfied. Now, Lets break down various components of a Balance Sheet.

Assets

Assets are resources controlled by the company as a result of past events and from which future economic benefits are expected to flow to the company (E.g. Land, machines, plants, future receivables from customers etc.)

Assets side of the balance sheet is made of two broad categories :

- Non Current Assets

- Current Assets

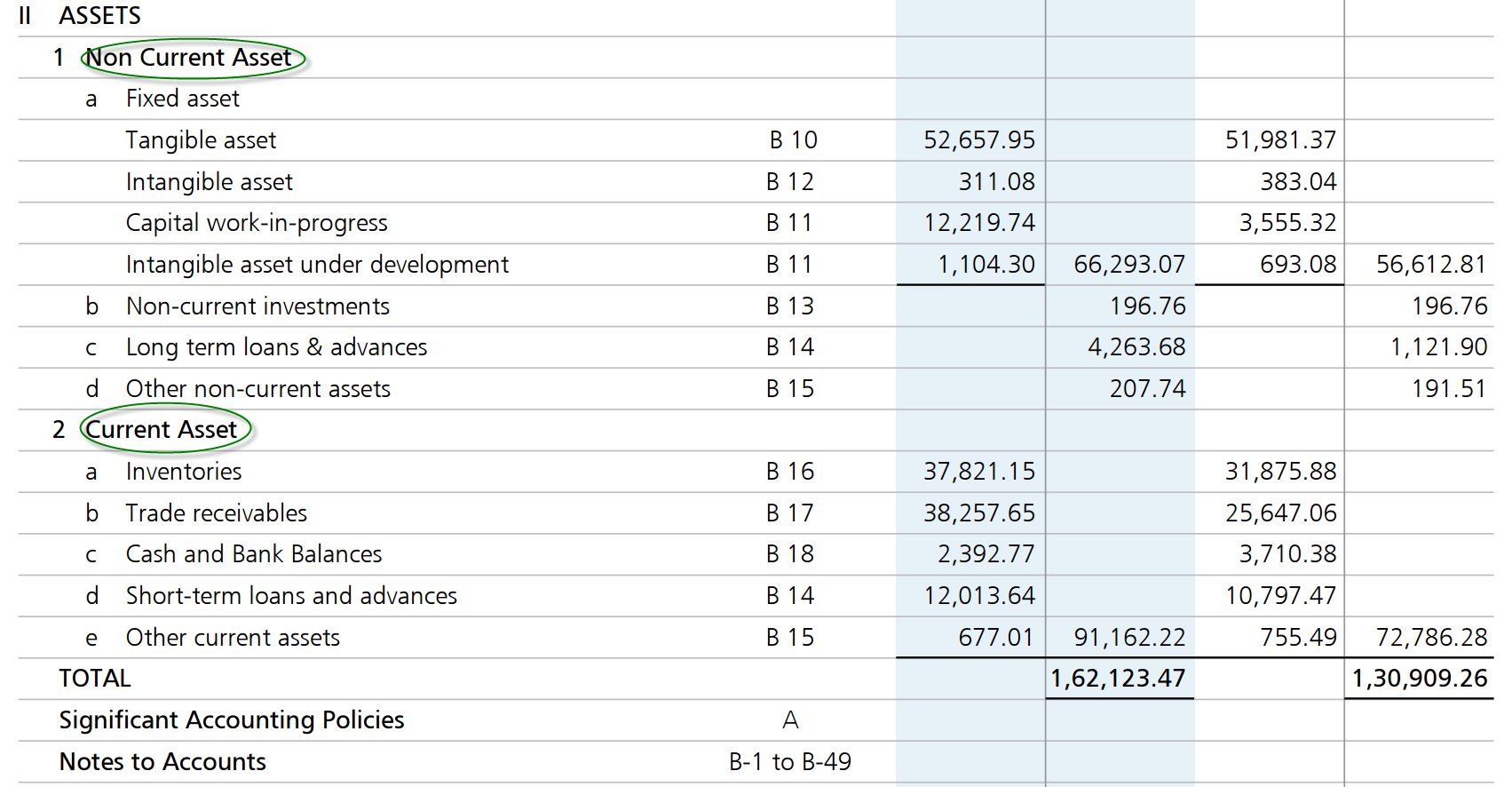

Below we can see the Assets side of the balance sheet for PI Industries.

We will break down break down Non Current Assets and Current Assets into their components and analyze them one by one.

Non Current Assets

These are the assets that are not easily convertible to cash or not expected to become cash within the next year. Non Current Assets can be divided into :

- Fixed Assets

- Long Term Investments

- Long Term Loans and Advances

Let’s see them one by one.

Fixed Assets

- These are assets whose future economic benefit is probable to flow into the the business, and whose cost can be measured reliably.

- These are items of value a company owns and will use for an extended period of time.

- For e.g. If you own a factory , the machines and equipments, the land on which it is situated are all fixed assets.

Fixed assets again can be divided into :

- Tangible Assets

- Intangible Assets

- Capital Work in Progress

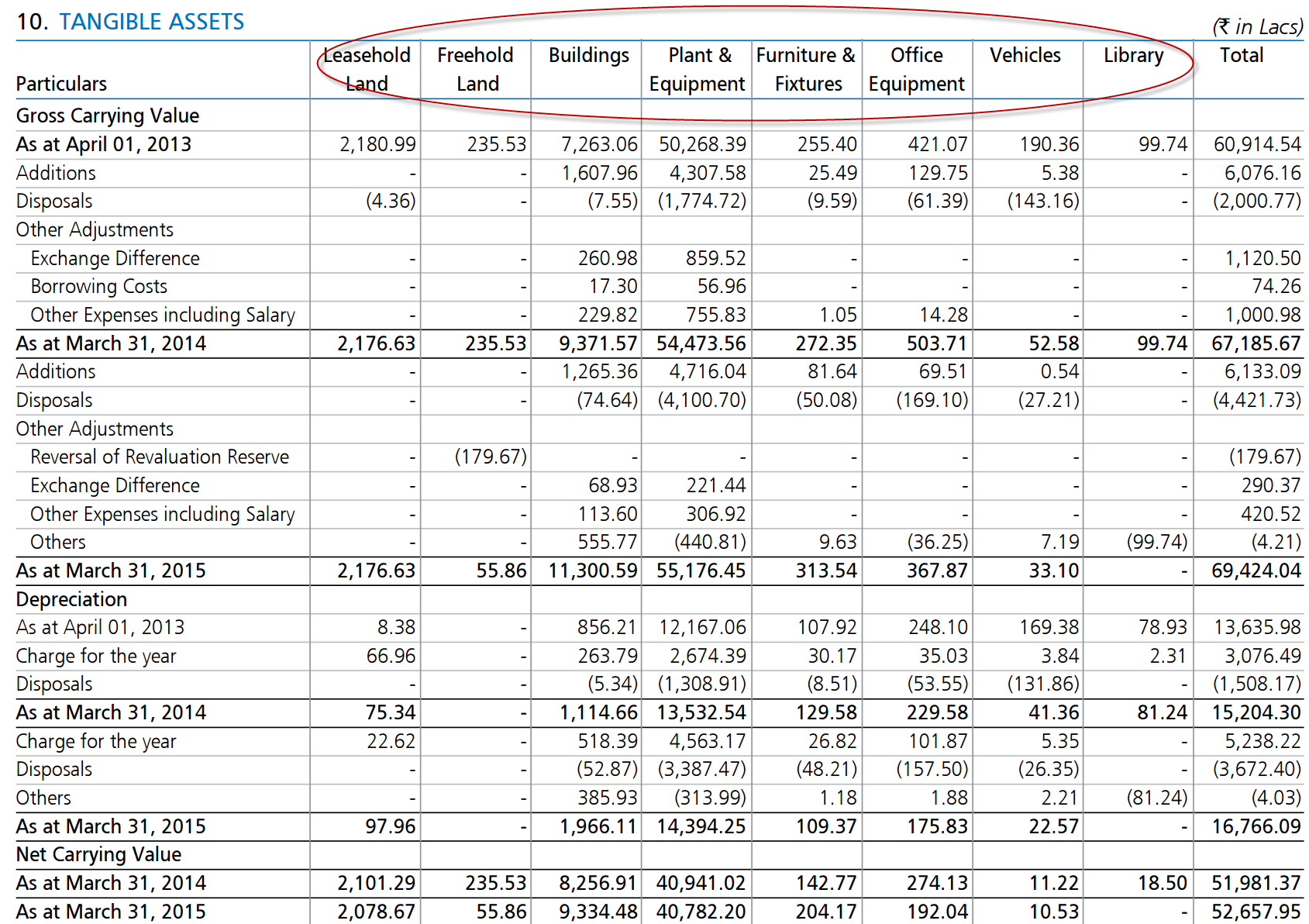

Tangible Assets

- They have a physical form and can be seen and felt.

- Tangible Assets include items like land, building, plants and equipment,vehicles, equipments etc.

Below we can see the Tangible Assets for PI.

Tangible Assets for PI consisted of Leasehold Land, Freehold land, Buildings, Plants and Equipment etc.

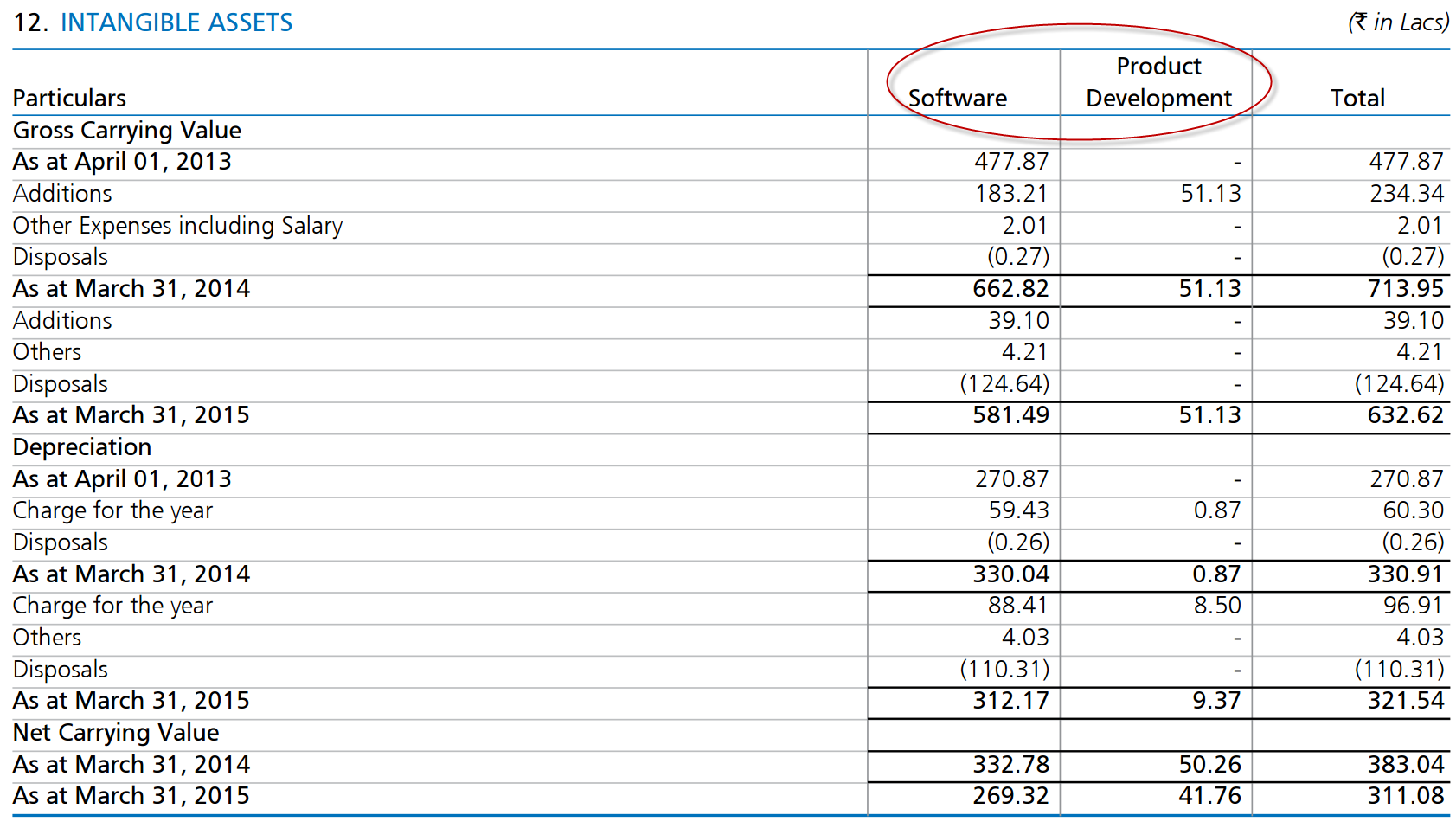

Intangible Assets

- These are long terms assets of a company that have no physical existence but hold tremendous relevance for the company as it is at its core of existence.

- Intangible Assets include goodwill, patents, copyrights, technical know-how, computer software , trademarks, brands etc.

- Goodwill is recognized when a business acquires another business.

- It represents the excess of cost paid by the purchasing business to the purchased business over the fair value of purchased business identifiable assets.

Intangible Assets for PI consisted of Software, Product Development.

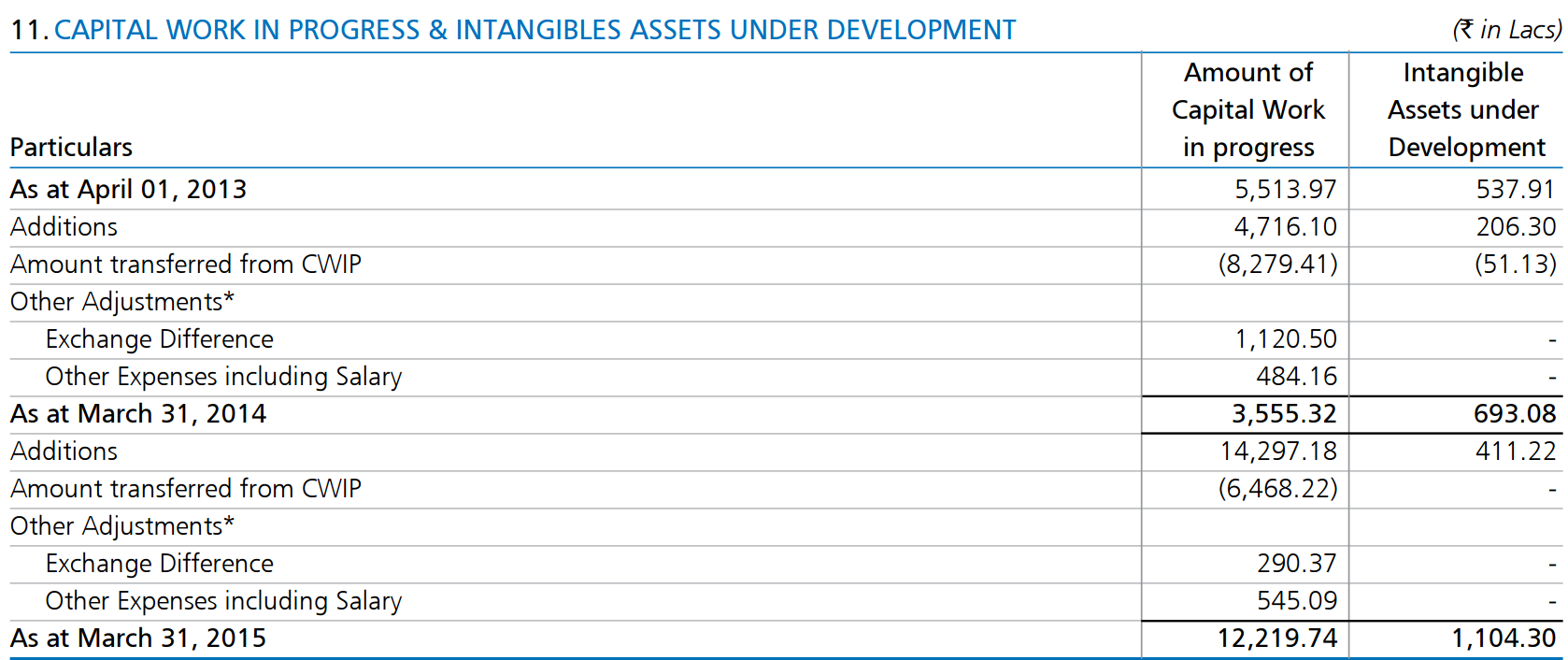

Capital Work in Progress

These are assets that are in progress of being built and possibly under construction when the balance sheet was prepared. Once these assets are built, they get shifted to tangible assets or intangible assets.

Long Term Investment

- These are the investments that have a horizon of one or more year and are considered long term from tax purpose.

- These are usually made by a company in order to secure an additional income or a strategic goal.

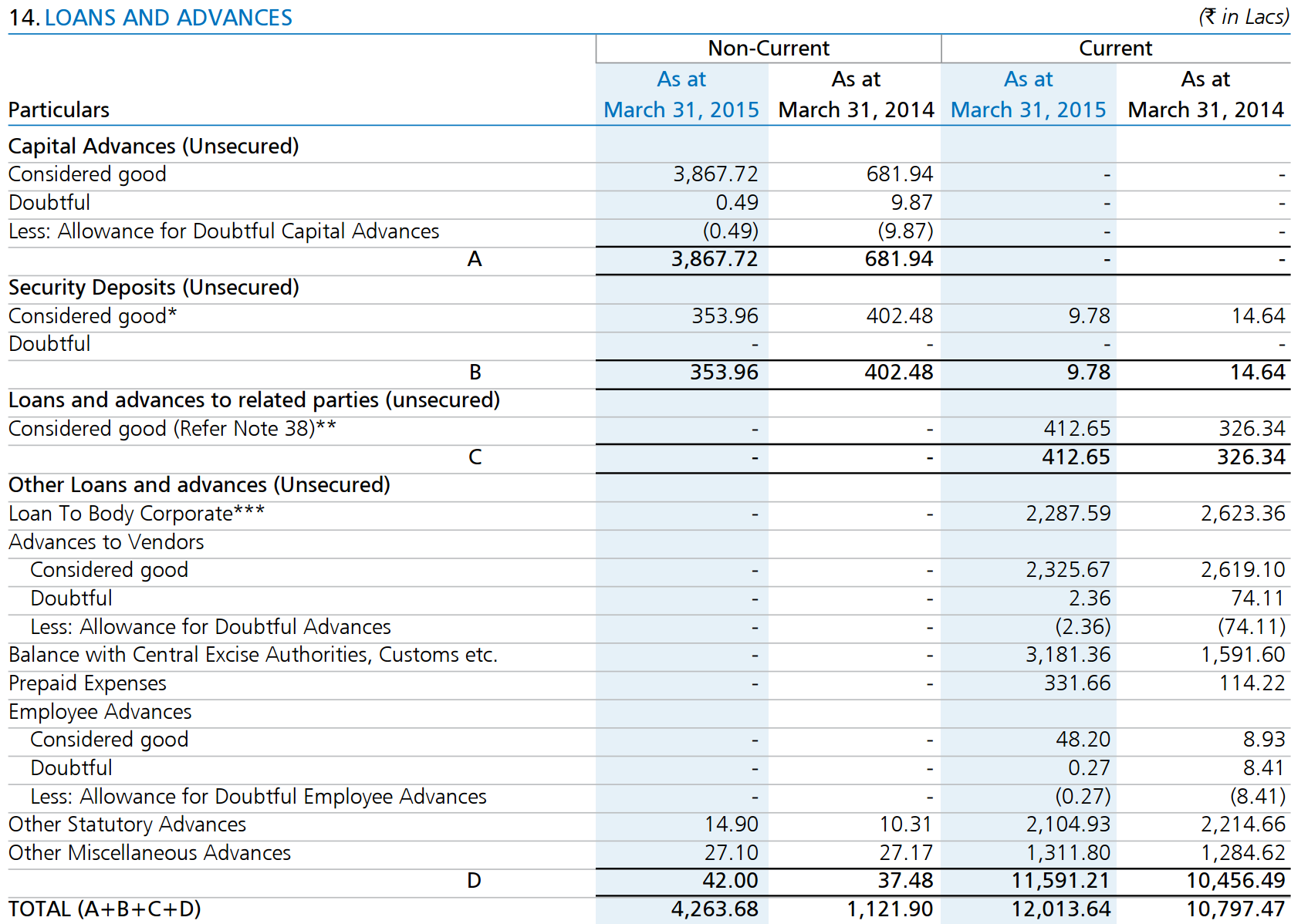

Long Term Loans & Advances

These represent any loans and advance payments that the company has granted to employees , suppliers and government and which are to be received by the company in a period beyond one-year.

Other Non Current Assets

These are obligations that are not going to be paid off within the year or operating cycle.

Current Assets

Current assets are assets expected to be realized or intended for sale or consumption in the business’s normal operating cycle , or within one year.

Current Assets can be broken down into :

- Current Investments

- Inventories

- Trade Receivables

- Cash and Cash Equivalents

- Short term Loans and Advances

- Other Current Assets

Let’s have a look at them one by one.

Current Investments

- These are investments that a company makes for a short period of time, largely a horizon of less than one year.

- Most companies in strong cash position have a short term investments account on the balance sheet

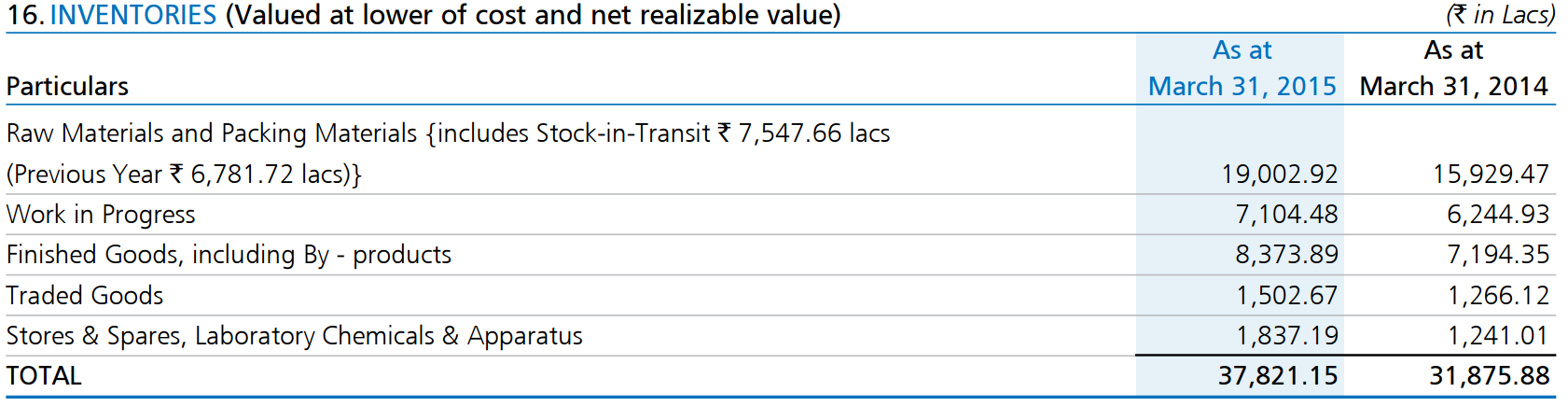

Inventories

Inventories include items like raw materials, work-in-progress goods and completely finished goods that are considered to be the portion of a business assets that are ready or will be ready for sale.

Inventory is one of the most important assets that most business possess. The reason being the turnover of inventory (conversion of raw materials into finished products, which when sold bring in cash for the company) represents one of the primary sources of revenue generation and subsequent earnings for the company’s shareholders/owners.

Some pointers on size of inventory:

- Large Inventory:

- Large Inventory for long amount of time is usually not good for business because of inventory storage, obsolescence and spoilage costs.

- An abnormally large inventory suggest that a good part of the merchandise may be unsalable and that its price may have to be drastically reduced in order to move it.

- Small Inventory:

- Too little inventory isn’t good either, because business runs the risk of losing out on potential sales and potential market share as well.

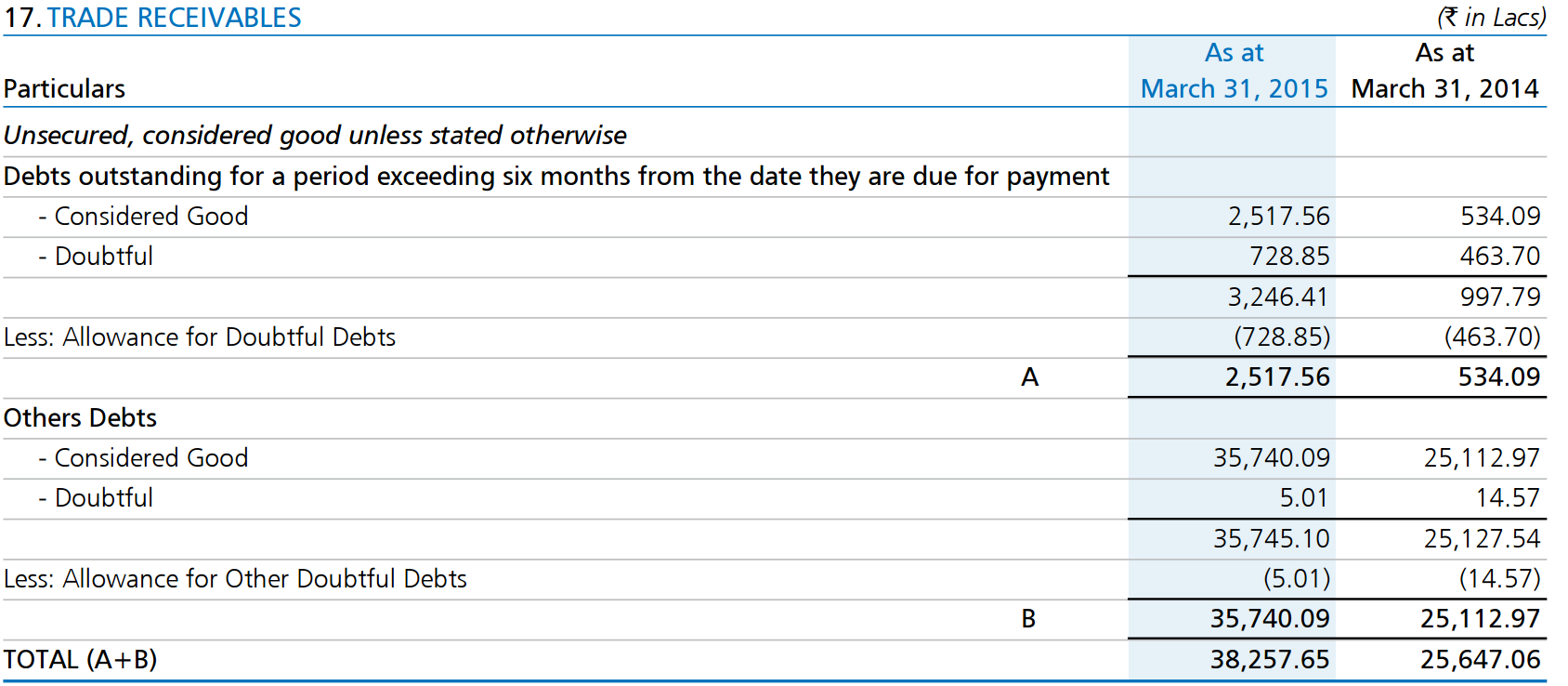

Trade Receivables

- These represent the money owed to the company by its customers to whom it sold goods or services on credit.

- E.g. If a company sells its vehicles worth 1 million $ to its dealers and receives money from them in 60 days, the 1 million $ will show as trade receivables on the balance sheet until the time actual payment is received by the company

- Bad Debts

- Sometimes few customers do not pay up even after the company waits for the payment after specified time.These defaults are called bad debts.

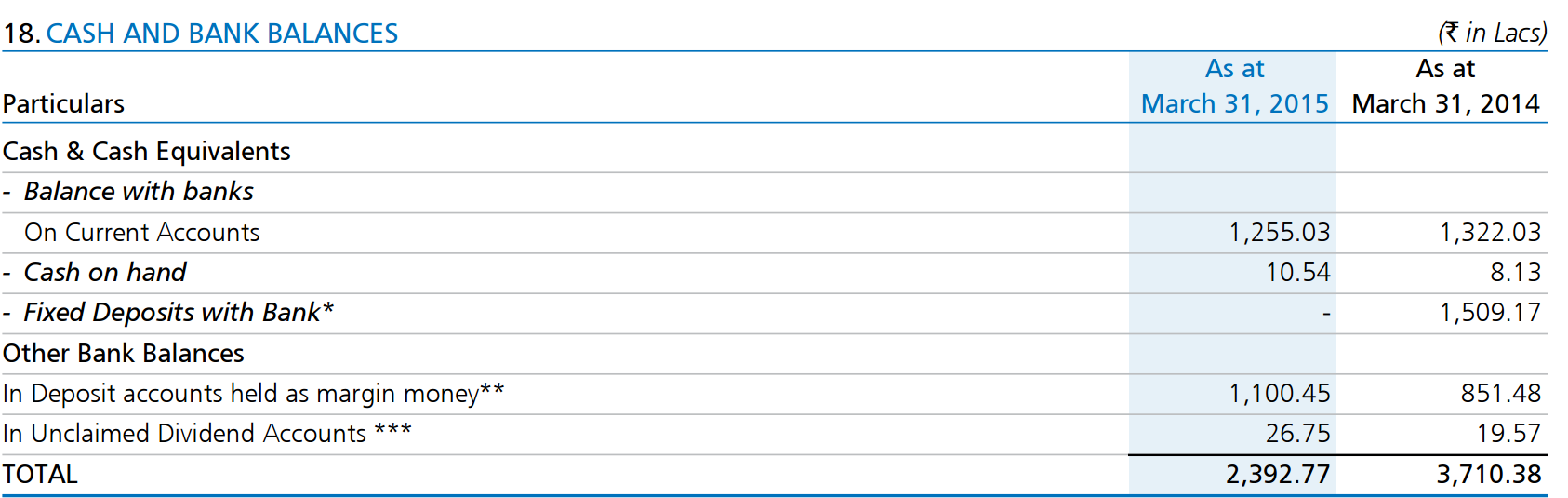

Cash and Cash Equivalents

- Cash is the most liquid asset found in a company’s balance sheet.

- Cash Equivalents have short term existence, they mature within 3 months whereas short term investments are 12 months or less.

- Higher cash value indicate business is liquid. (It is expected not to face any difficulty in paying short term liabilities)

- Cash is not “the cash flow” or “free cash flow” that you may have been heard. Cash is what remains on balance sheet after adjusting for all cash inflows and outflows during the period.

- To assess the total cash a company has , it is important to add the ‘Current Investment’ the company owns.

Short term loans and Advances

These are like long term loans and advances but for period less than on year.

Other Current Assets

These are assets that do not include cash, investments, receivables, and inventory and can be converted into cash within on business cycle which is usually less than one year.

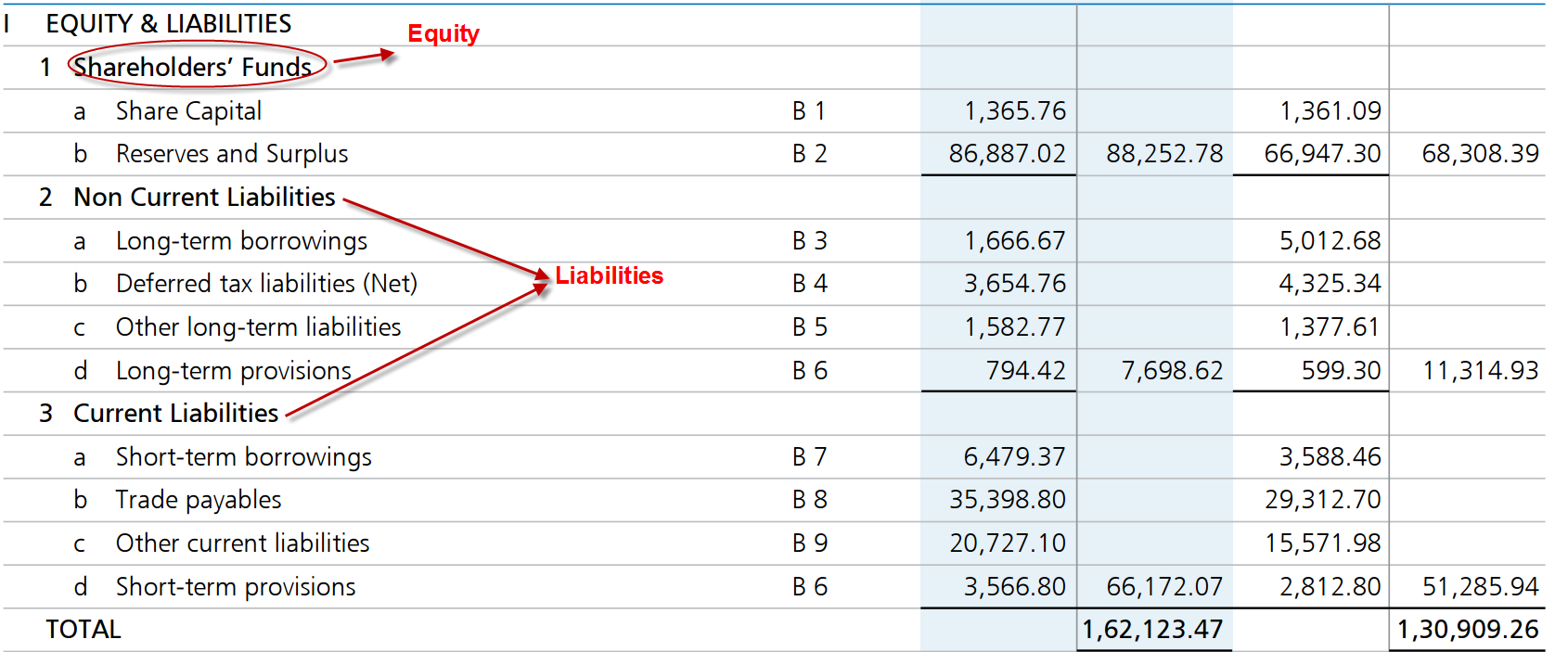

Equity and Liabilities

Equity

Equity represents the portion belonging to owners or shareholders of a business.

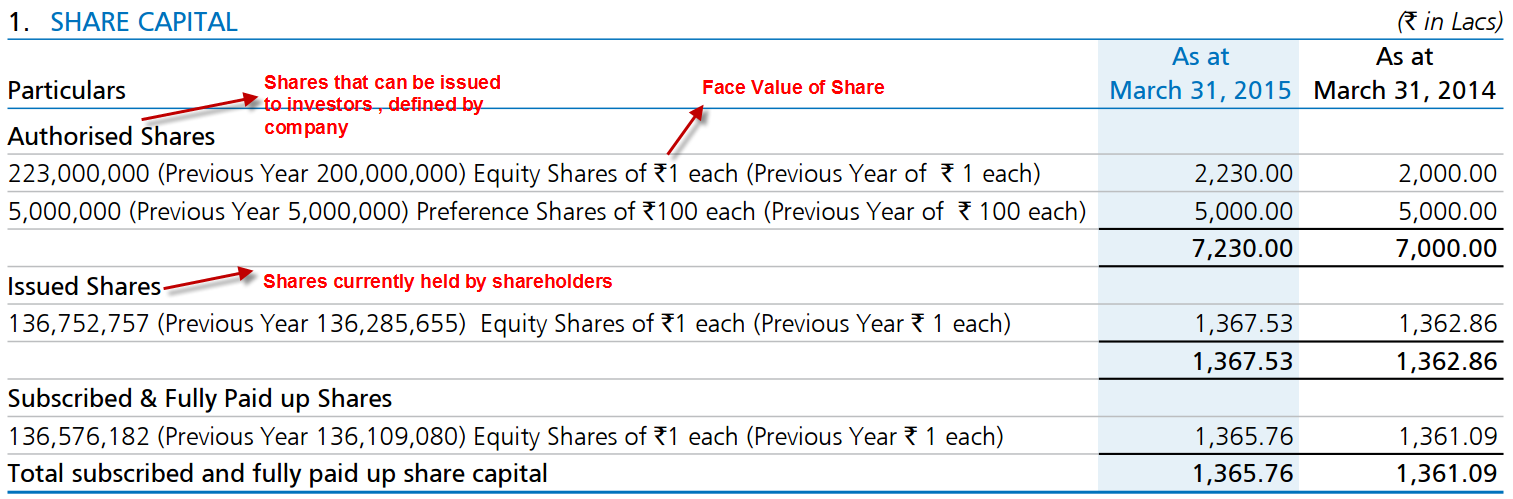

Equity is subdivided into :

1. Share capital

Suppose a company were to issue 500 new shares in an IPO. The shares have a face value of 5 and IPO Price of 100.

Here is how the addition is made to equity:

- 5 of face value * 500 shares =2500 will be added to share capital.

- Share premium (100 -5)* 100=47500 will be added to reserves and surplus under share premium reserves

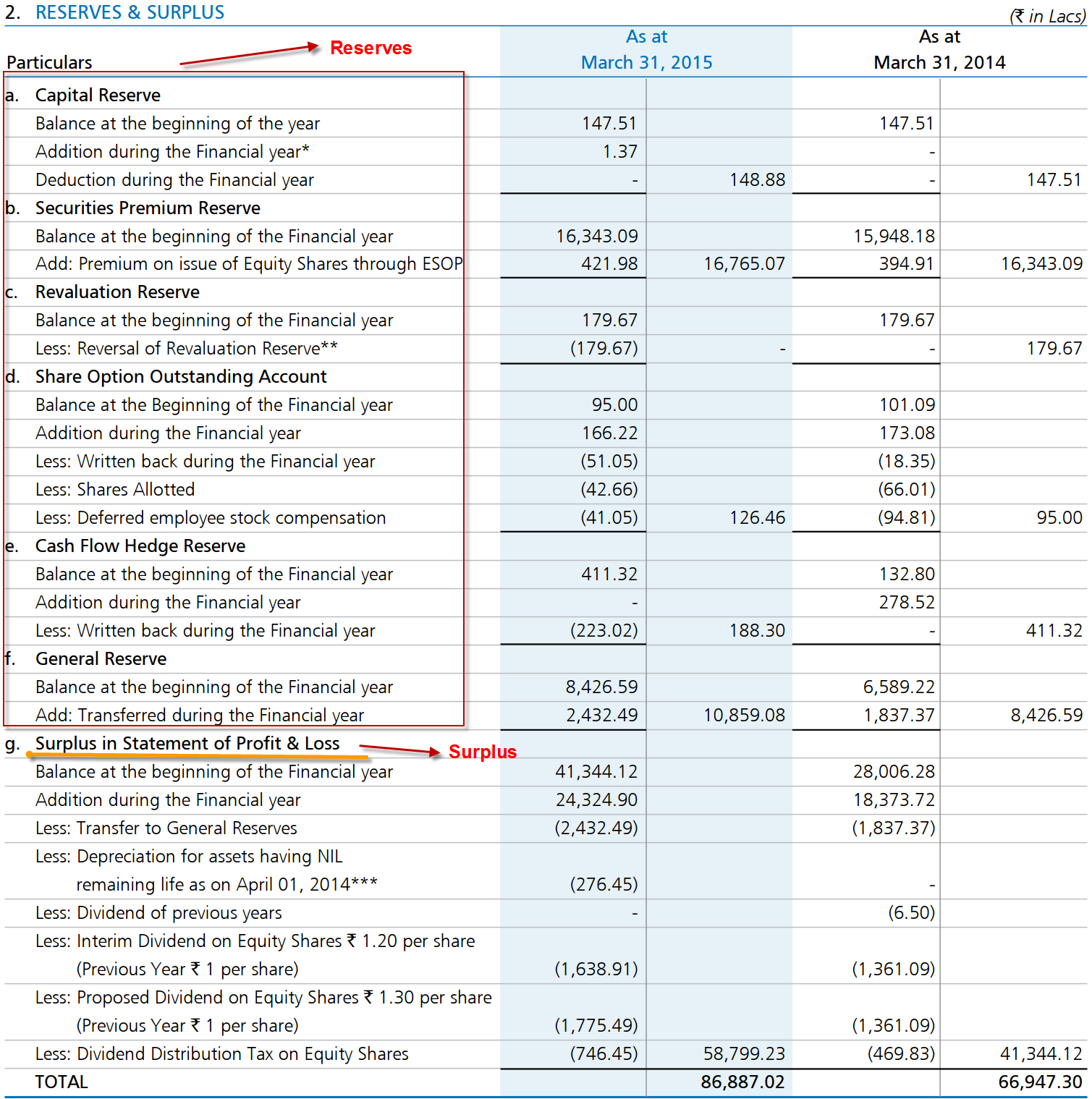

2. Reserves and surplus

- General reserves

- Consist of profit which company has not distributed among shareholders.

- Surplus

- This is where company adds its annual profit straight from the income statement, again before distributing any money as dividends to shareholders, but not allocated to any specific purpose.

Equity capital is the ultimate determinant of a company’s borrowing capacity.

Liabilities

Liabilities are obligations of a company arising from past events, the settlement of which is expected to result in an outflow of economic benefits from the company (like bank borrowings and future payments to suppliers)

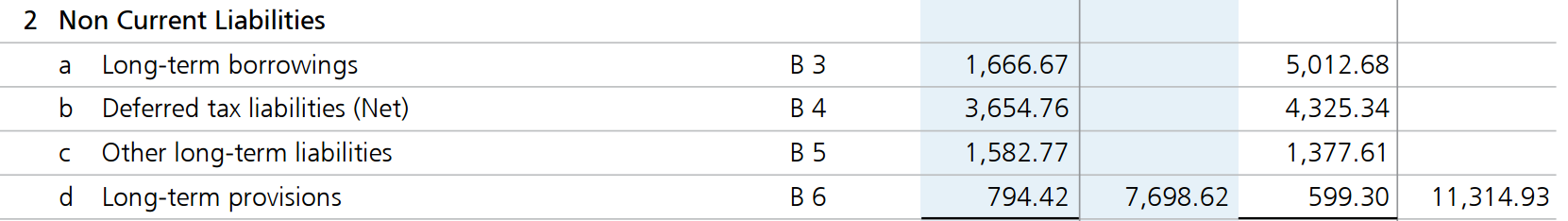

Non Current Liabilities

These are contracted commitments to pay back a sum of money over time with interest.

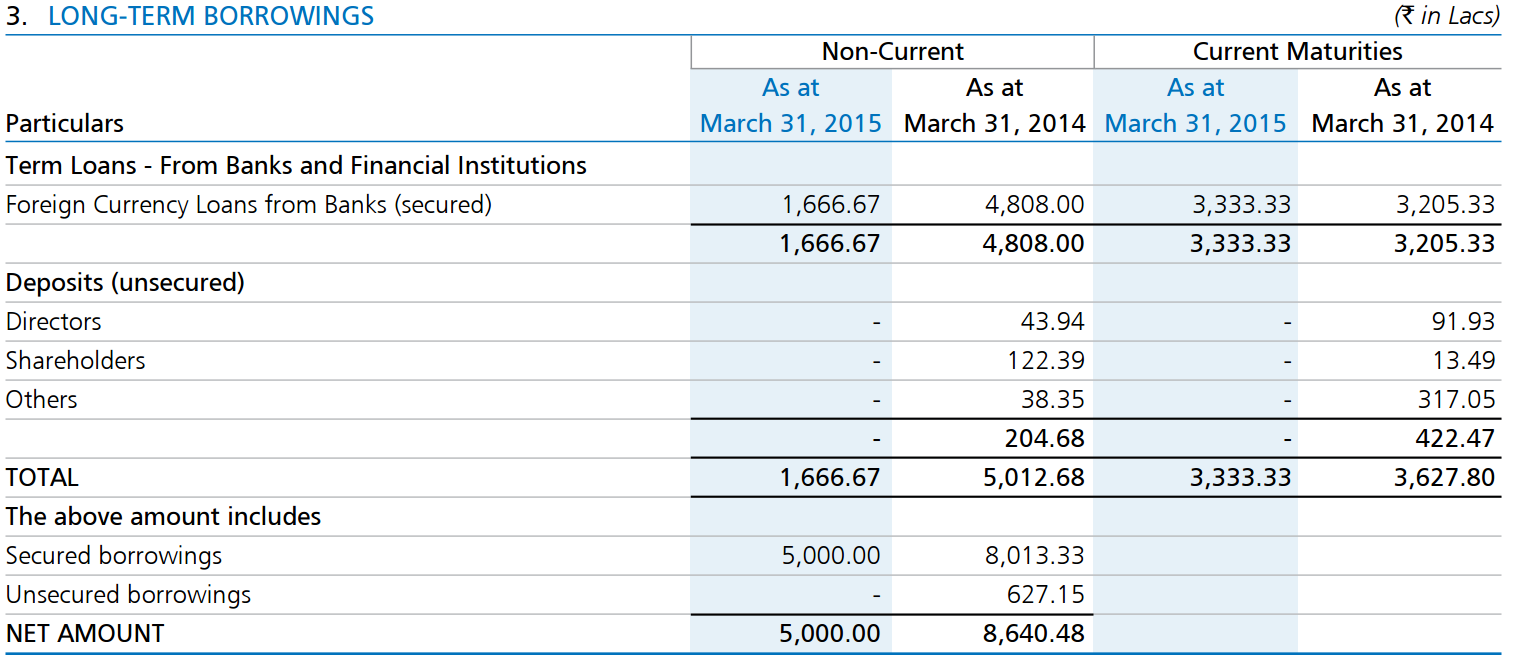

Long term borrowings

Loan and financial obligations that last over one year. These can be like the car loan which you are suppose to pay over a period of many years.

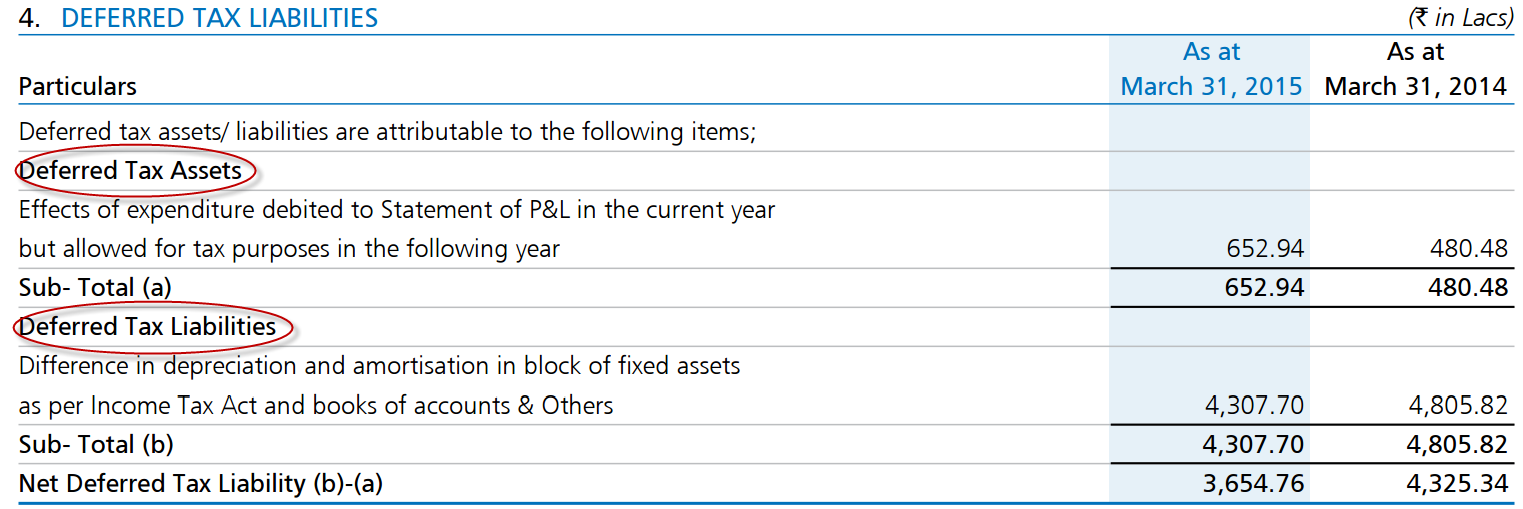

Deferred Tax liabilities

They arise due to difference between profit as per the company’s act and as per the income tax act

There are mainly two types of deferred taxes :

- Deferred Tax Assets : They generally arise where tax relief is provided after an expense is deducted for accounting purposes.

- Examples of such situations include:

- A company may accrue an accounting expense in relation to a provision such as bad debts, but tax relief may not be obtained until the provision is utilized

- A company may incur tax losses and be able to “carry forward” losses to reduce taxable income in future years..

- Examples of such situations include:

-

Deferred tax liabilities: They generally arise where tax relief is provided in advance of an accounting expense/unpaid liabilities, or income is accrued but not taxed until received

Consider an example for deferred tax liability : Assume a company buys machine for Rs 10 crore. The depreciation that can be claimed in the company’s account as per companies act is say 20% . The depreciation as per income tax act is 50%.

The deferred tax liability calculation would be calculated for the first year:

- Value of a machine = 10 crore

- Depreciation as per companies act = 20% * 10 crore = Rs 2 crore

- Depreciation as per income tax act= 50% * 10 crore= Rs 5 crore

- Difference = 2-5= -3 crore

- Differed tax liability @30% tax rate= 3 * 30% = .9 crore

- 0.9 crore of deferred tax is something which company has to pay up in the future as is thus a liability.

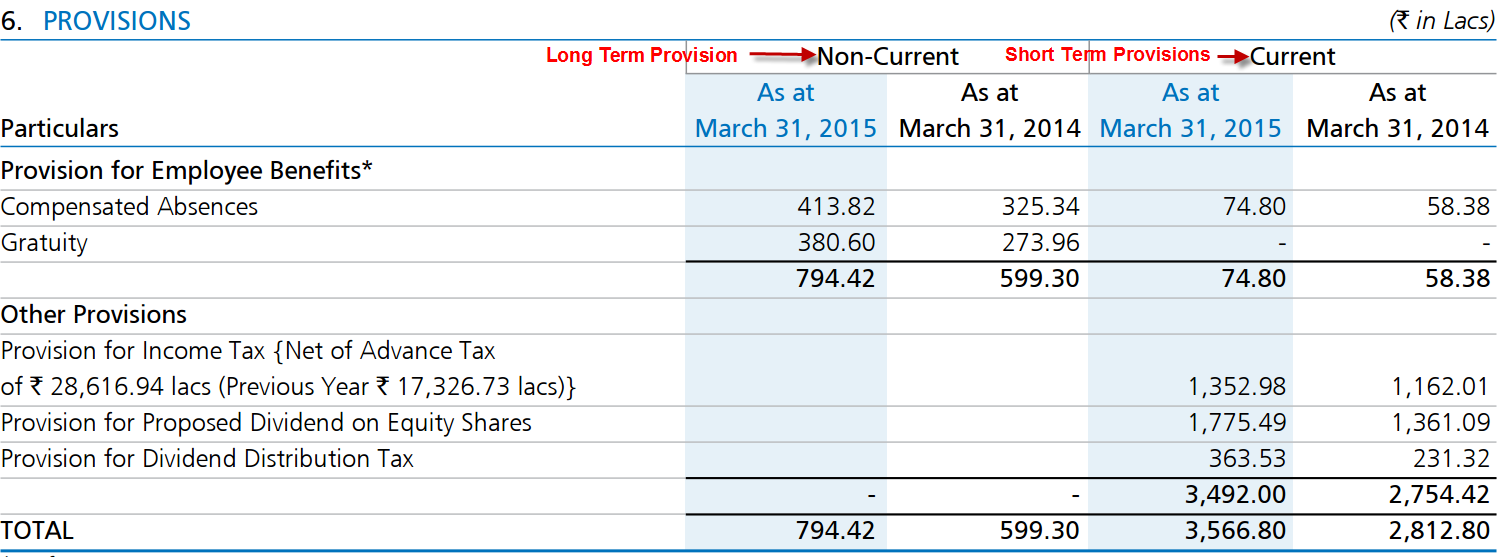

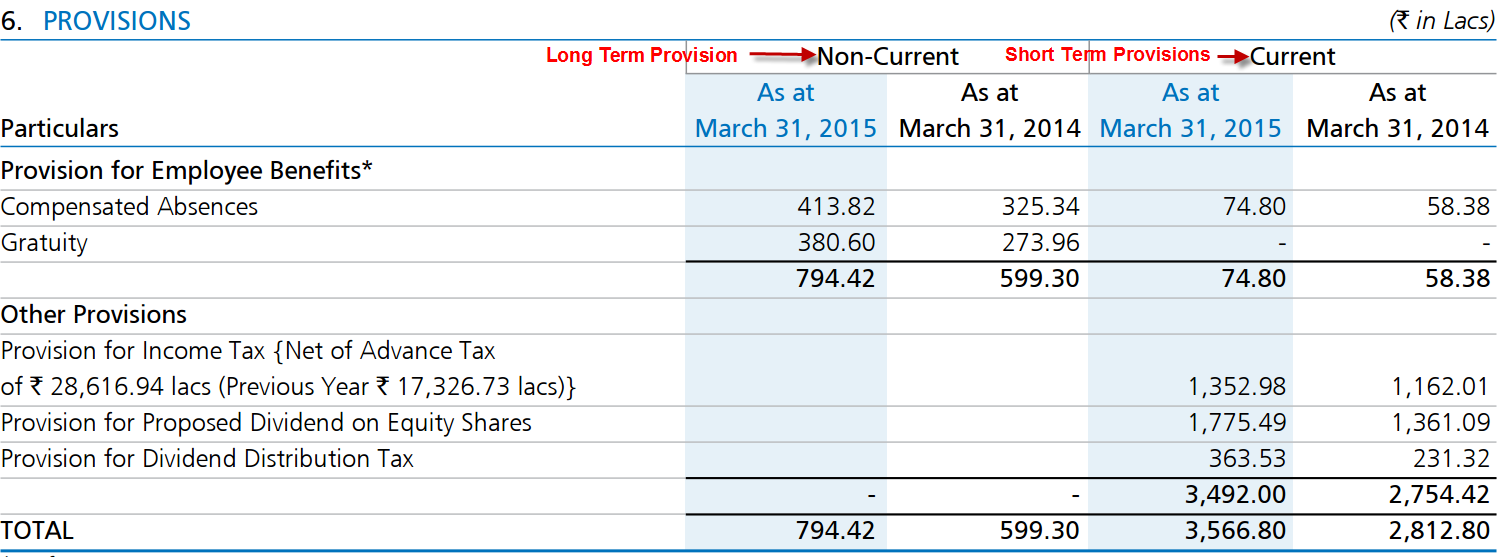

Long term provisions

These represent money that is provided for future liabilities like any payment expected beyond one year on account of leave encashment or for warranties on products etc.

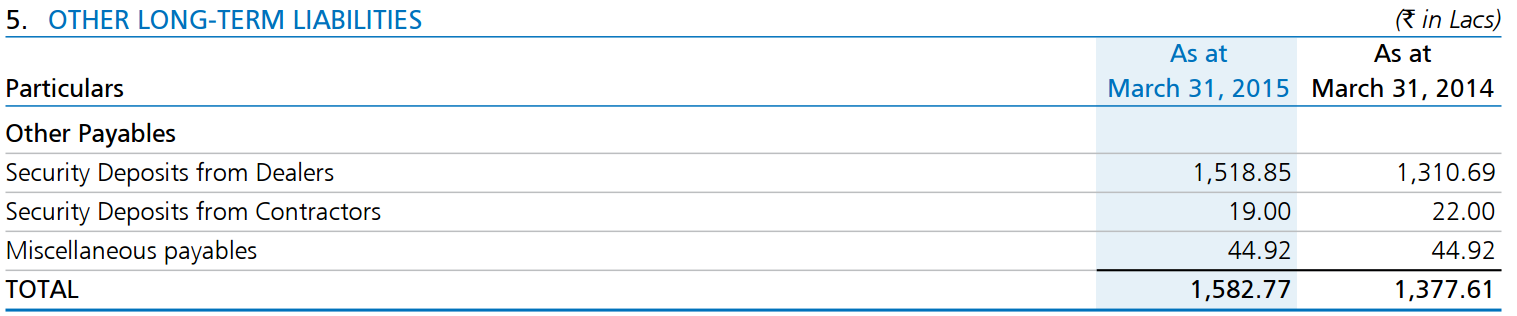

Other Long term liabilities

These broadly include obligations of the company that become due more than 1 year into future.

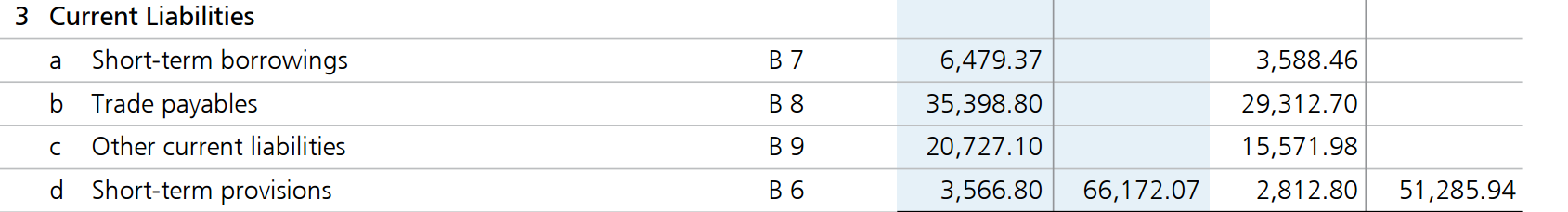

Current Liabilities

Liabilities for which payment is due normally in less than one year.

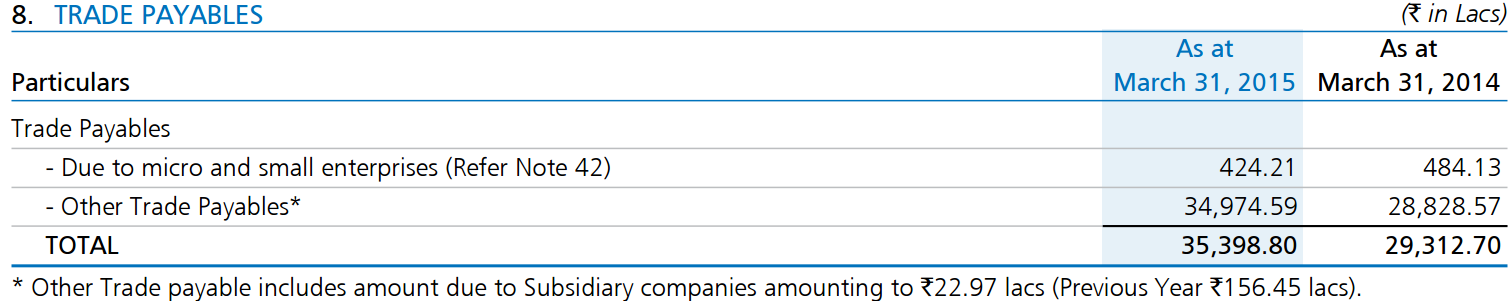

Trade payables/Account payables

Represents amount a business owes its vendors for goods and services that were purchased from them but which have not yet been paid.

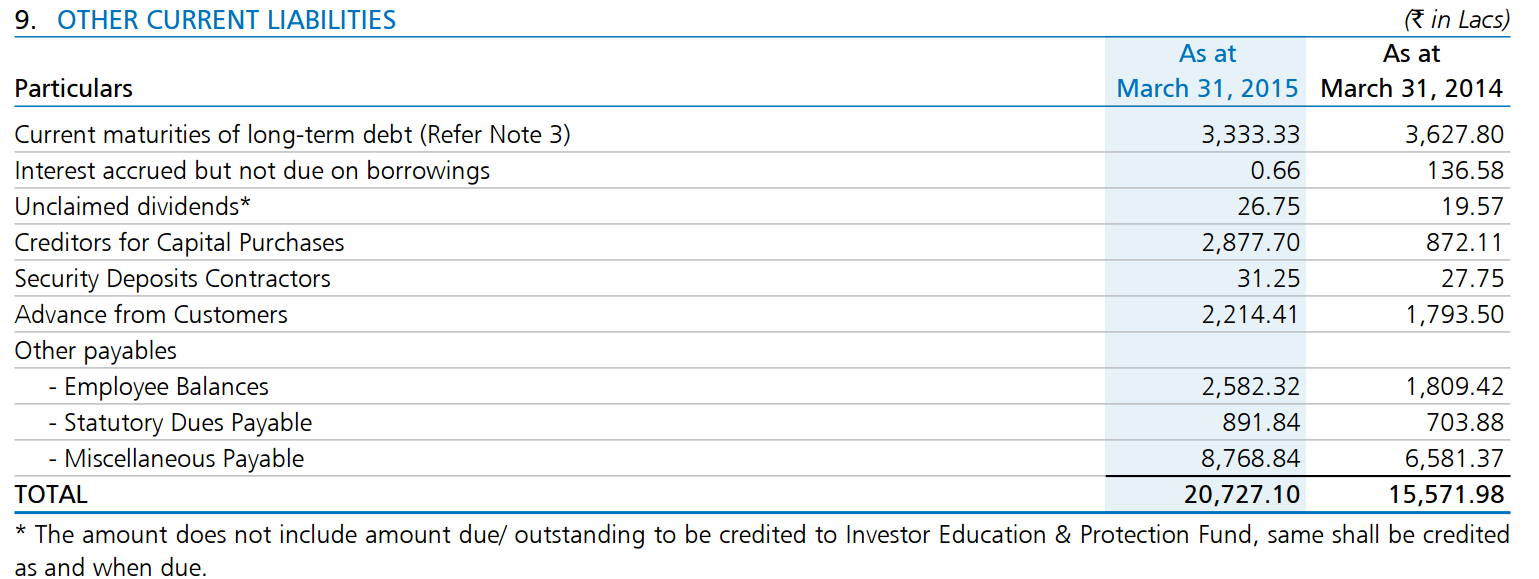

Other current liabilities

Short term payables not directly related to the main business of the company. These include statutory dues, security deposits and advances from dealers and unclaimed liabilities which are all due for payment within one year.

Short term provisions/ Current Provisions

Money that is provided for a liability that is expected to occur within one year. E.g. Proposed dividend to be paid out to shareholders, payment for warranties on products.

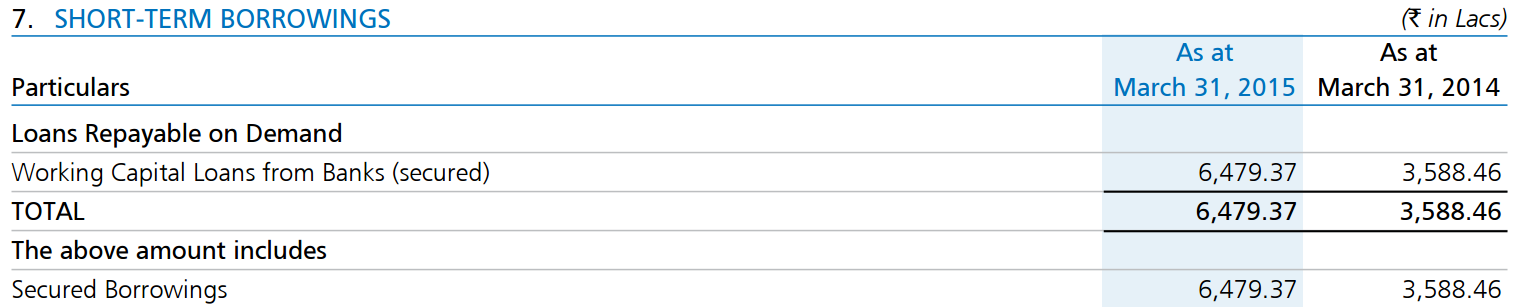

Short term borrowings

These represent Loans and financial obligations due within one year. These can be like credit card or personal loan you borrow, and which have to be repaid over the next one year.

Point to note:

- Don’t take too much note of current liabilities other than spot large changes or trends.

- High current liabilities can result in higher effective returns on capital with relatively low cost and risk.

Minority Interest

- Only occurs in consolidated balance sheet (that combines the account of a company and its subsidiaries)

- Minority interest represents the portion of consolidated subsidiaries owned by others.

E.g. Say Tata motors owns 85% of JLR, which becomes the formers subsidiaries.

- Now 100% of JLR’s assets and liabilities would be included in the consolidated balance sheet of TM.

- Minority interest would represent the 15% of the net assets of JLR not owned by TM.

Some pointers on Balance Sheet

Balance sheet is a powerful indicator of a business’s health. It gives a snapshot of company’s health.

We need to be cognizant of some practical issues with balance sheets:

- Balance Sheet is a static indicator. It tells about where the company has been and how well it did getting to where it is now. However, it doesn’t tell much about the future of the business and about future income.

- It is useful to have a summary of the values of all the assets owned by an enterprise, however these values are frequently elusive in nature as they may not be their true value.

- Value of company’s ‘Human Capital’- the skills and creativity of its employees cannot be valued precisely enough to reflect it on the balance sheet.

Overall, Balance Sheet is a remarkable statement that every investor must not miss reading and analyzing.

Further reading :

Leave a Comment