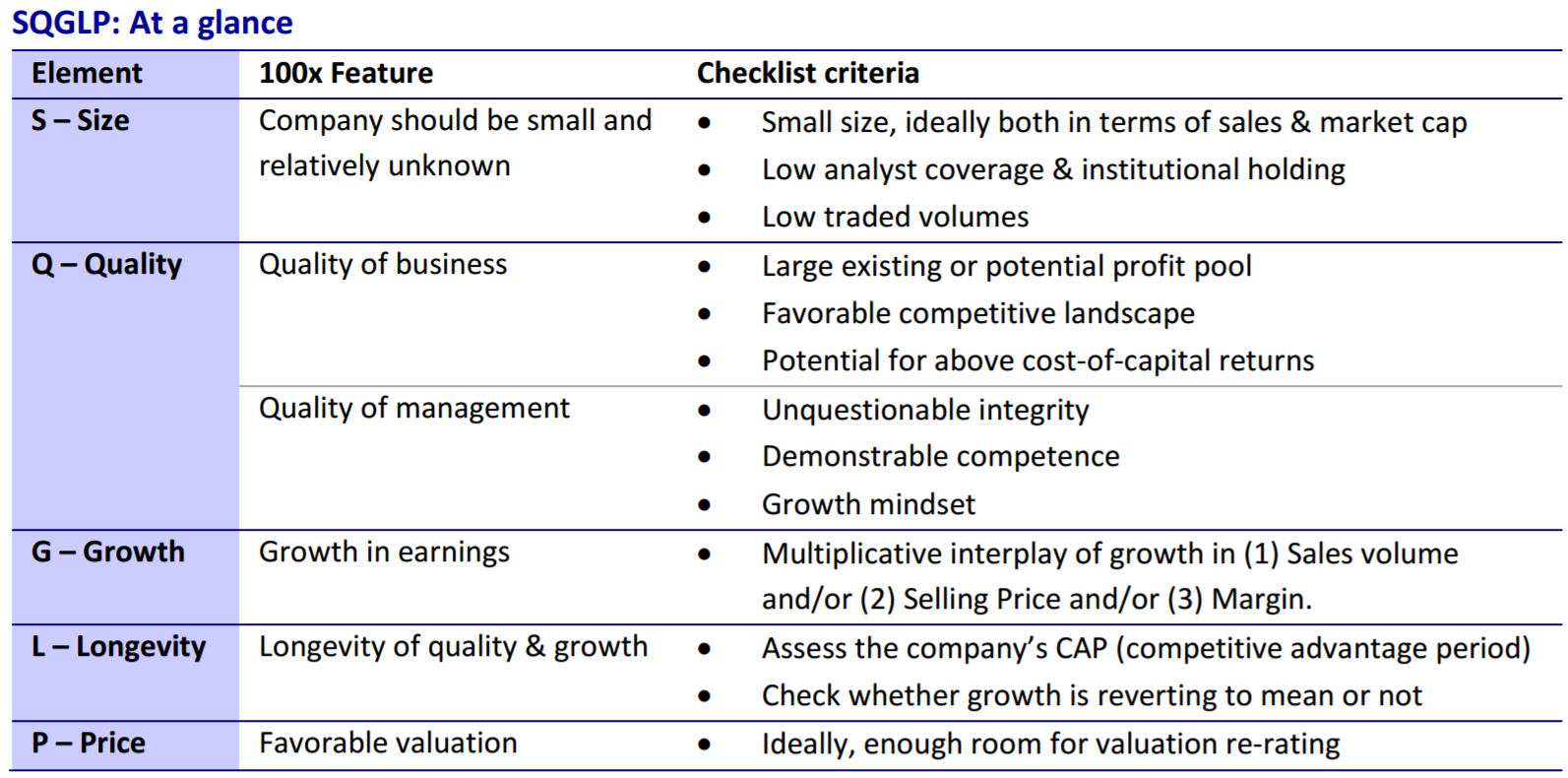

The SQGLP (Size, Quality, Growth, Longevity, Price) Framework for identifying multibagger stocks.

Table of Content

- The essence of 100x stocks

This article is Part 1 in a 2-Part Series.

- Part 1 - This Article

- Part 2 - The power of growth in Wealth Creation

The essence of 100x stocks

Motilal Oswal has some very good Annual Wealth Creation Studies. They are a highly recommended read. I especially liked the 19th Wealth creation Study where the the theme was the power of growth in Wealth Creation. You can read the original report here

I have tried to capture some important ideas from the study that details the SQGLP (Size, Quality, Growth, Longevity, Price) Framework.

This framework is useful in researching about multibagger stocks in a structured manner. Size, Quality, Growth, Longevity, Price for a business are all important factors and considering them in decision making will improve the odds of finding multibagger stock ideas.

The SQLGP framework is described as below:

Lets go through each component of the framework.

1. Size is a key driver of the low-base effect

Most of the 100 bagger companies were small and relatively unknown at the time purchase. By small it means both in Market Cap and Sales. They were relatively unknown with low institutional holding, less analyst coverage and trading volumes.

The low base effect plays a crucial role in the big returns. Low-base effect: Elementary examples

Example :

- Stock A priced at INR100 rising to INR140 (absolute gain INR40) is 40% gain.

- Stock B priced at INR20 rising to INR40 (absolute gain only INR20) is 100% gain

- If indeed the objective is to earn INR40, all that investors need to do is buy TWO stocks of B. This would earn INR40 by investing only INR40 compared to the INR100 invested in Stock B.

If a company SmallCo with INR1 million sales wants to grow 100-fold, it needs additional sales of INR99 million. But for even a high-growth company like Infosys to now grow 100-fold would require additional sales which is 99 times its FY14 sales of INR500 billion i.e. NR49,500 billion! Of course, this too may happen but is likely to take much longer time than for SmallCo to reach INR100m.

Dimensions of size : Revenue and Market Cap

This is where the characteristic of “relatively unknown” becomes relevant.

- Low institutional holding,

- Low number of brokerage analysts covering the stock

- Relatively low traded volumes.

KEY TAKEAWAY:

Considering growth in the economy, inflation, stock market levels, etc, the hunting ground for potential 100x stocks should be companies with market cap not significantly exceeding USD0.5 billion or INR30 billion.

2. Quality

Quality of a business is the product of :

- Quality of Business

- Quality of Management

2.1 Quality of Business

Quality of business needs to be assessed for factors like existing or potential size of profit pool for the industry (and hence the company), competitive landscape, potential for sustained above cost-of-capital return on investment, etc.

With the above backdrop, we briefly cover the following determinants of quality of business:

- Profit Pool

- Value Migration

- Dominant market shares

- Niche opportunity

- Low competitive intensity

- Competitive advantage / Economic Moat

- Favorable demand-supply dynamics.

2.1.1 Profit Pool

KEY TAKEAWAY:

Barring the odd sunrise business, most 100x stocks going forward too are likely to emerge from these very high Profit Pool sectors.

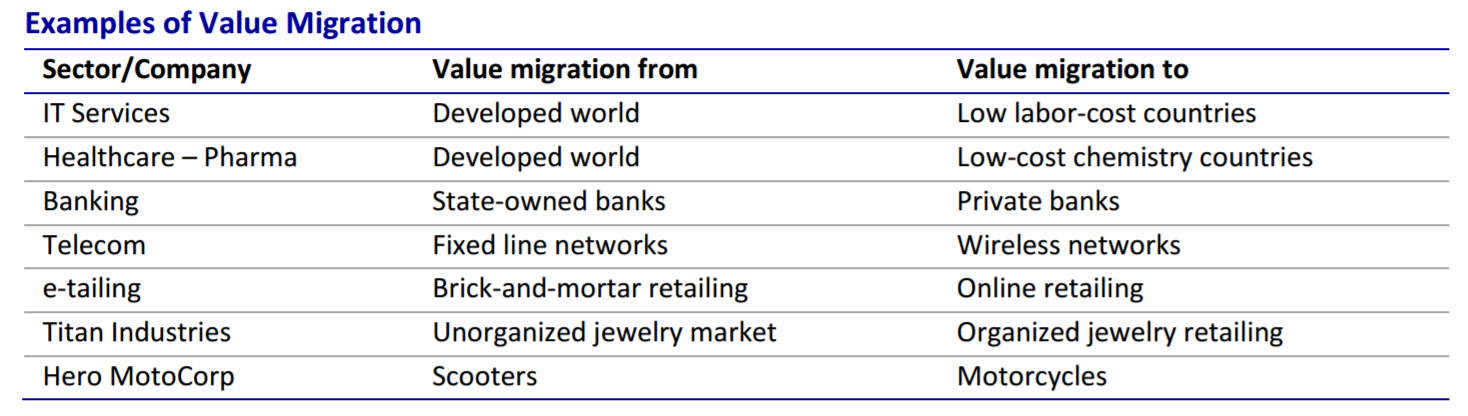

2.1.2 Value Migration

Value Migration is one of the most potent catalysts of the 100x alchemy as it creates a sizable and sustained business opportunity for its beneficiaries. It has two broad varieties –

-

Global Value Migration e.g. global manufacturing value migrating to China; value in IT and health-care sectors migrating to India, etc

-

Local Value Migration e.g. value in telephony migrating from wired networks to wireless networks; value in Indian banking migrating from public sector banks to private banks.

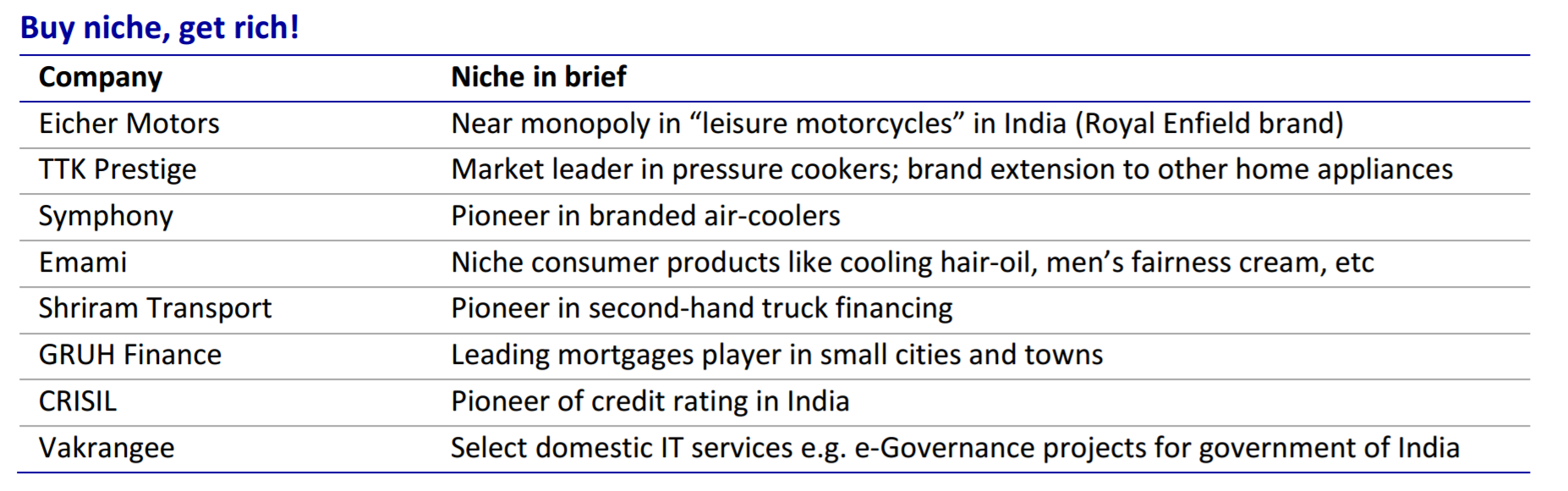

2.1.3 Niche Opportunity

Pioneers or market leaders in these niche opportunities are potential candidates for 100x.

KEY TAKEAWAY:

Most of the niche companies seem to go through several rounds of trial and error (e.g. TTK Prestige is established in 1955, but has been a mediocre company till as recent as FY09). Hence, it may be prudent to buy into such companies only after they have secured their business model.

2.1.4 Dominant market shares

Dominant market share in a consolidated business with medium to high growth is a potential source for 100x. Two factors works out favorably in such situations :

- Even in a consolidated market, the leader tends to gradually gain market share , ensuring that it grows faster than the market

- The dominant player tends to enjoy pricing power which insures profitability.

2.1.5 Low Competitive Intensity

Businesses with low competitive intensity are more favorable for 100x stocks.

2.1.6 Economic Moat/Competitive Advantage

An excellent test of whether a company has economic moat or not is whether it enjoys return on capital higher than industry average.

2.1.7 Favorable demand-supply dynamics

Favorable demand-supply is a key enabler of 100x, especially in commodity businesses like metals, cements and chemicals. The plays out at two levels :

- Macro Sector Level * When aggregate demand in any sector exceeds aggregate capacity. It creates a “supply squeeze” , causing end product prices to soar. This drives up company products.

- Company Level * In this case, company’s capacity to supply increases significantly faster than the sector, driving up volumes, profit and in turn stock prices.

2.2 Quality of Management

There are 3 main aspects of to quality of management :

- Unquestionable Integrity

- Demonstrable competence

- Growth Mindset

As these are subjective and non quantifiable issues, asessing quality of management is a true art rather than science. Below indicators can serve as a broad checklist for this process:

3. Growth

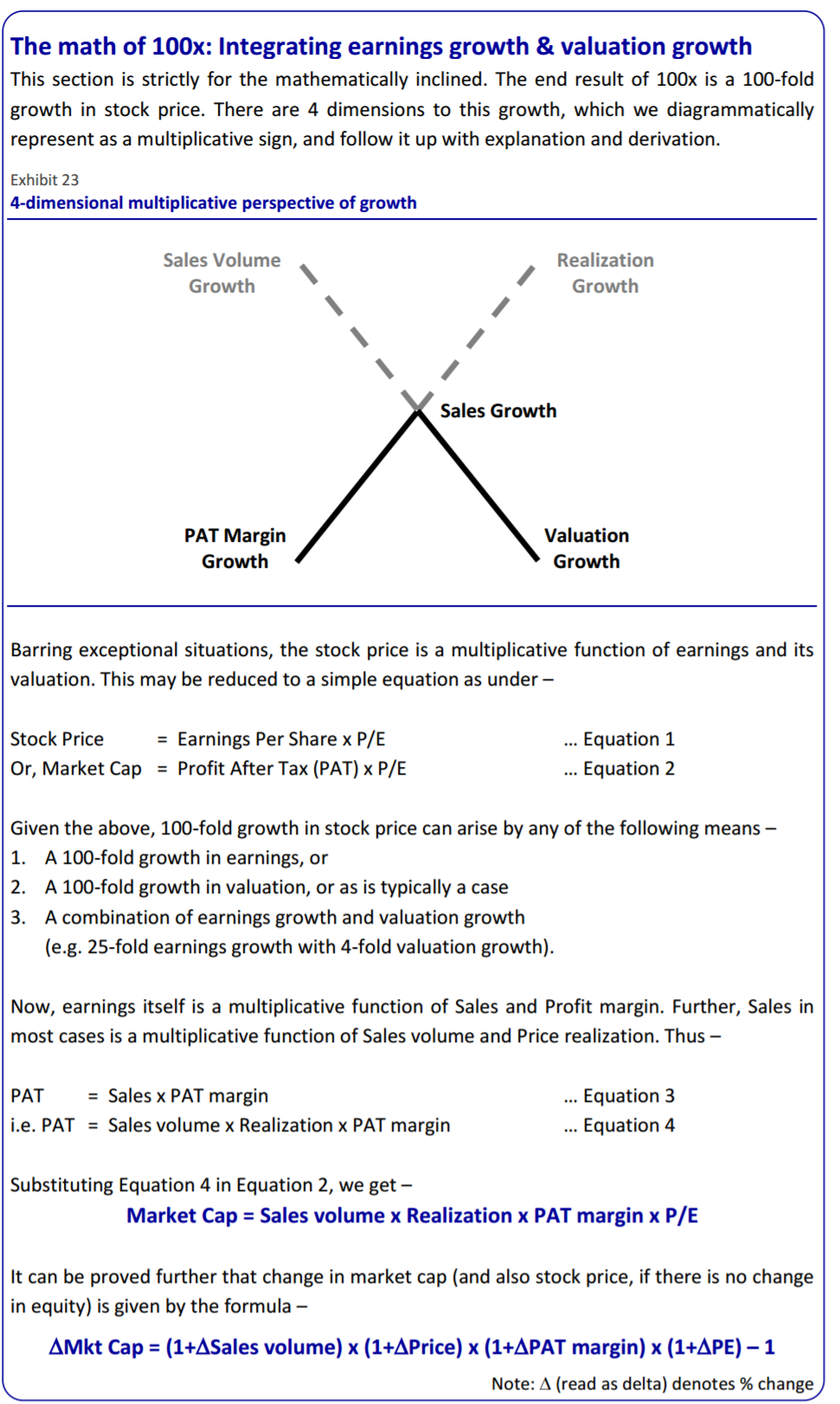

As for a building, its foundation is somewhat invisible but its most important part. Similarly for a 100x, small size and quality of business and management is its foundation. Upon these the superstructure comes in the form of stock price growth.

There are two dimensions of growth -

- Earnings

- Valuation

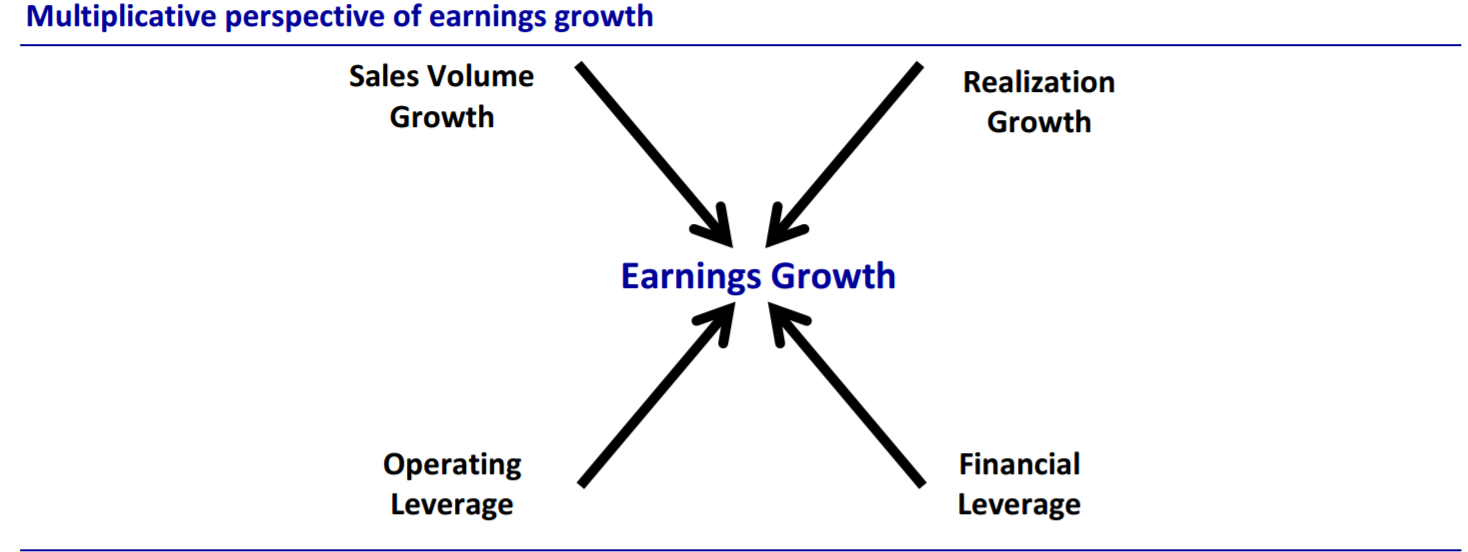

3.1 Earnings growth

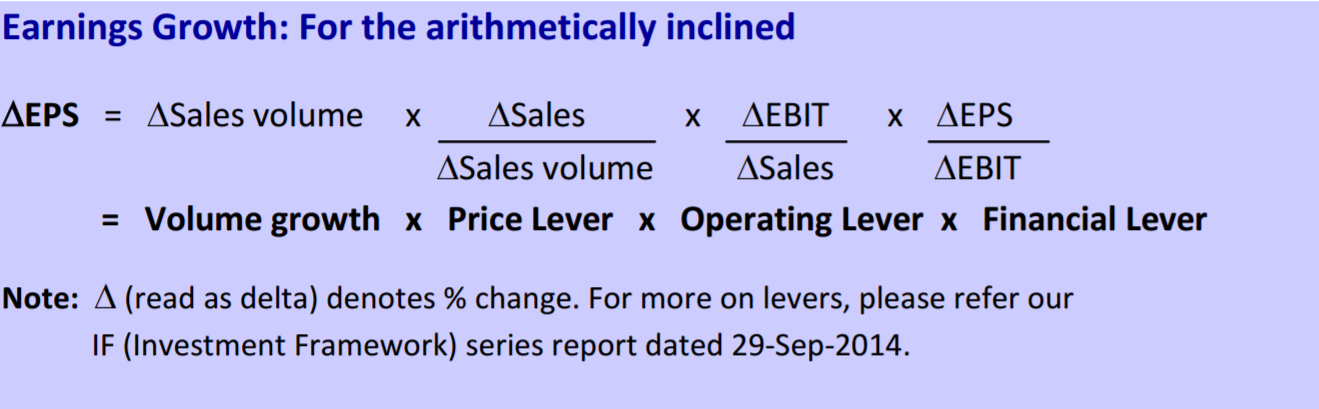

Earnings growth is a quantitative reflection of Quality of business and management. There are four dimensions to it.

- Volume growth – a function of demand growth matched by company’s capacity to supply;

- Price growth – a function of company’s pricing power, which in turn is a function of the competitive landscape

- Operating leverage – a function of the company’s operating cost structure; higher the fixed cost, lower the unit cost incidence and higher the operating leverage

- Financial Leverage – a function of the company’s capital structure; higher the debt-equity, higher the financial leverage and vice versa.

3.2 Valuation growth

The simplest way to improve the odds of valuation growth is by ensuring favorable valuation at the time of purchase. A further simple rule of favorable valuation is single-digit P/E

(Note: In certain situations, low P/E may not be the sole determinant of favorable valuation e.g. during bottom-of-cycle, earnings of cyclical stocks are depressed leading to high P/Es; likewise, where companies are expected to turn from loss to profit, current P/E cannot be calculated.)

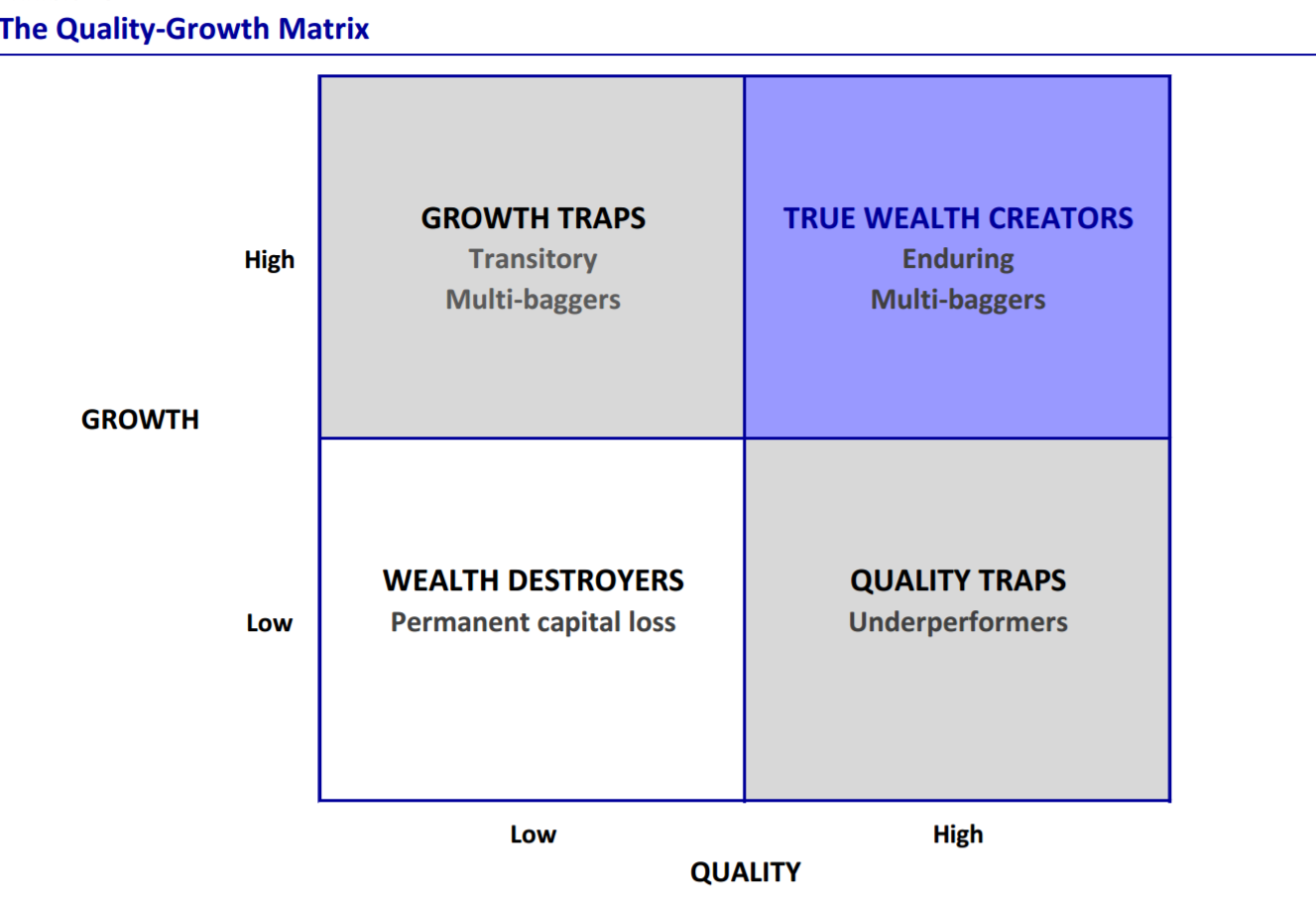

Note : Quality Vs Growth

It is important to clearly distinguish between quality of a company and its growth prospects. Growth is not a function of quality alone, but several other factors as discussed before like value migration, demand-supply dynamics etc. In binary terms, for any given company, Quality can be high or low and growth can be high or low.

Have a look at the Quality Growth Matrix below :

Some key points observed from the matrix are :

- Low-Quality-Low-Growth: Such companies and their stocks are clearly avoidable.

- Low-Quality-High-Growth:

- Such companies may prove to be Growth Traps. The high growth in these companies is most likely due to cyclical upturns, but gets mistaken for secular high quality. If bought very cheap, such stocks may still end up as multi-baggers, but at best transitory.

- High-Quality-Low-Growth:

- Such companies may prove to be Quality Traps . The high quality in these companies blinds investors to the possibility that these companies may not be able to grow their earnings at a healthy pace due to low underlying base rate (e.g. Castrol in lubricants, Colgate in oral care, Hindustan Unilever in soaps & detergents, etc). High RoE, high free cash flow and high dividend payouts ensure that these stocks enjoy (and indeed merit) rich valuations. So, they can be bought only when they trade at significant discount to their long-period valuations (e g. during extreme pessimism in the broader market or in the specific stock).

- High-Quality-High-Growth: These are the Enduring Multi-baggers, especially if bought at favorable valuations. Further, the companies here which also happen to be small in terms of market cap (typically under USD0.5 billion) are potential 100x candidates.

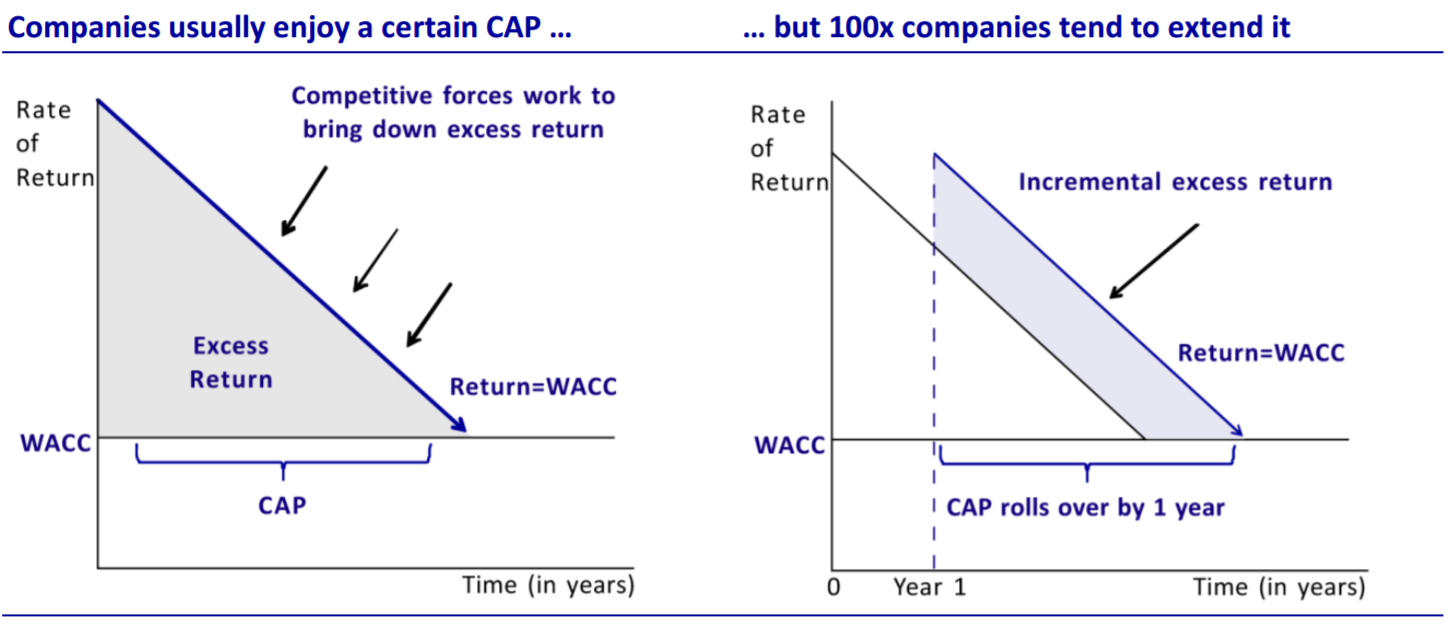

4. Longevity

The next step is assessing how long the company can keep the growing going. In the context of longevity, competence of management is tested at two levels –

- Extending CAP (i.e. Competitive Advantage Period)

- Delaying mean reversion of growth rate.

4.1 Extending Competitive Advantage Period (Cap)

Competitive advantage period (CAP) is the time during which a company generates returns on investment that significantly exceed its cost of capital.

4.2 Delaying mean reversion of growth rate

After the initial hyper- and high growth phases, rates tend to taper off to the mean rate (which is usually the nominal GDP growth rate). This is due to both competition and also the company’s own high-base effect. This is when competent managements can delay the reversion to mean either by

- new streams of organic growth

- inorganic growth via judicious, earnings accretive and value-enhancing acquisitions.

Thus, longevity of quality and growth is the key difference between transitory multi-baggers and 100x stocks.

5. Price

The simplest way to improve the odds of valuation growth is by ensuring favorable valuation at the time of purchase. A further simple rule of favorable valuation is single-digit P/E.

Leave a Comment