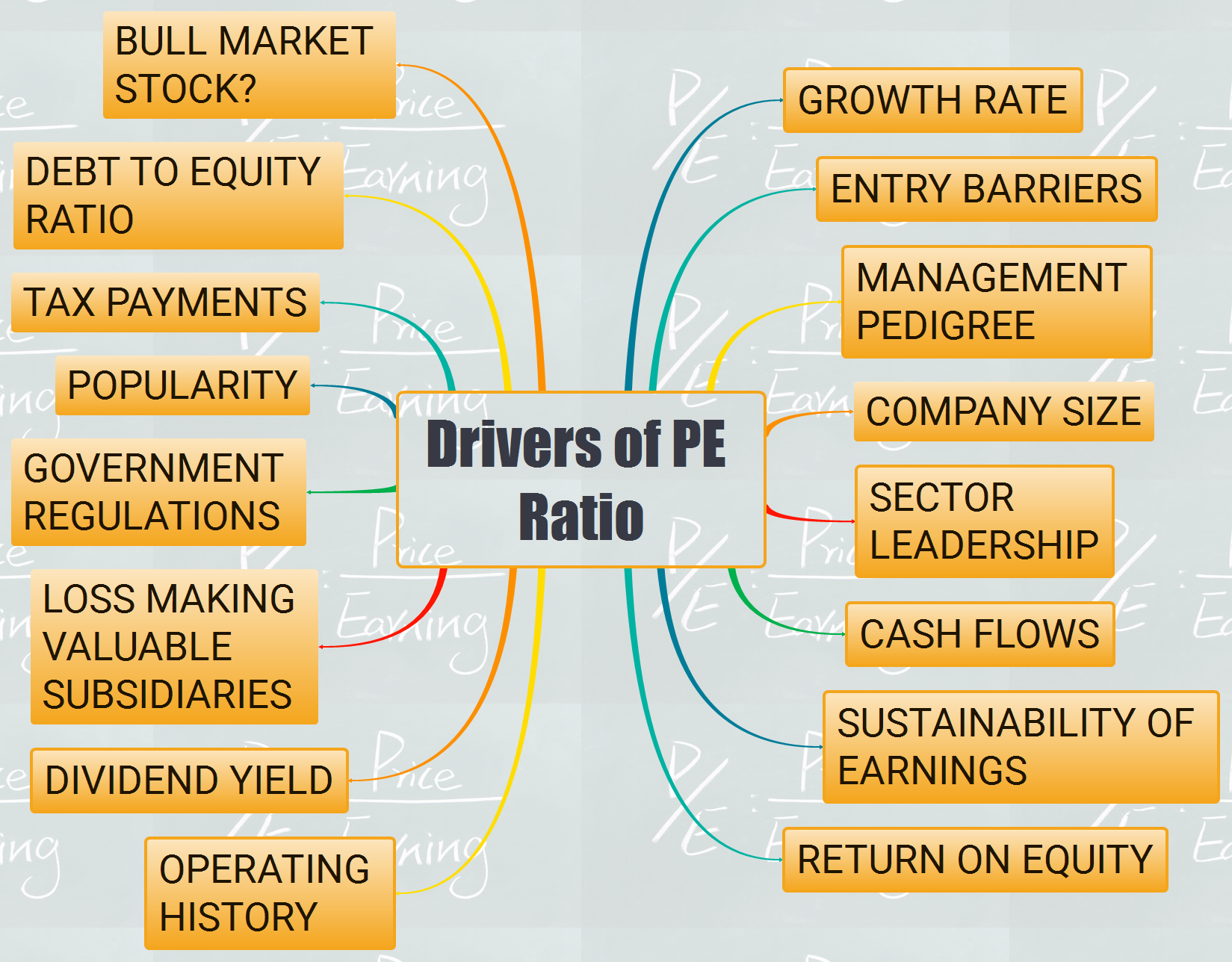

Drivers of Price to Earnings (P/E) Ratio

Introduction

The price to earnings (P/E) ratio of a stock is a perception of its future earnings. PE ratio of a stock forms an integral part of a stocks valuation matrix and varies across sectors and companies.

There are general misconceptions related to P/E ratio. For e.g many new investors mistake a stock with high P/E to fall at any time and a stock with a low P/E to move up in the future. It is difficult to predict the P/E ratio of a stock and most estimates are by extrapolating the current P/E into the future. The P/E is influenced and determined by various factors.

Below is mindmap for drivers of PE Ratio

The source of this mindmap is from Basant Maheshwari’s excellent book, ‘The Thoughtful Investor’. It is a very good book written with the context of Indian Equity Markets.

Leave a Comment