100 Baggers - Stock that return 100 to 1

This book is about 100-baggers. These are stocks that return $100 for every $1 invested.

- Book: 100 Baggers: Stocks That Return 100-to-1 and How To Find Them

- Author: Christopher W. Mayer

Table of Content

- The Essential Principles of finding 100-Baggers

- The most important principle:

- 1. You have to look for them

- 2. Value Added Growth

- 3. Lower Multiples are preferred

- 4. Economic Moats are a necessity

- 5. Smaller Companies are preferred

- 6. Owner-Operators Preferred

- 7. You Need Time: Use the Coffee-Can Approach as a Crutch

- 8. You Need a Really Good Filter

- 9. Luck Helps

- 10. You Should Be a Reluctant Seller

The Essential Principles of finding 100-Baggers

Author ‘Christopher W. Mayer’ has done a great job in digging and studying ‘100-baggers’ to identify definite patterns.

Some of the 100-Bagger stocks discussed in his book are :

| Company Name | Total Returns | Years to 100 |

|---|---|---|

| Berkshire Hathaway | 18261 | 19 |

| Kansas City Southern | 16931 | 18.2 |

| Altria Group | 15120 | 24.2 |

| Franklin Resources | 11363 | 4.2 |

| SouthWest Airlines | 5478 | 9.5 |

| Monster Beverage | 700 | 9.5 |

| Amazon | 283 | 13 |

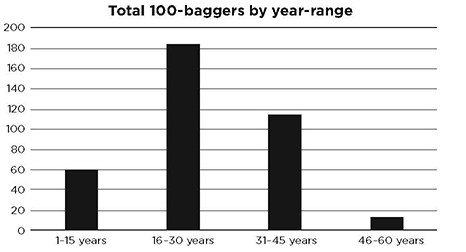

Most of the stocks took about 16-30 years to become 100 baggers. The graph below shows the total 100 baggers by year-range:

We should know that there is no magic formula for producing 100-baggers. There is no easy way to screen for them.

These notes are distilled principles which he mentions in his book . These are very handy principles and should be referred back time and gain in our quest for 100-baggers

We will start with the most important principle. Rest of the principles are ancillary to the main principle.

The most important principle:

The most important principle is :

Ability for a business to reinvest their free cash flow to earn above average returns

You need a business with high return on capital with the ability to reinvest and earn that high return on capital for years and years.

This has been quoted by legendary, Warren Buffet many times.

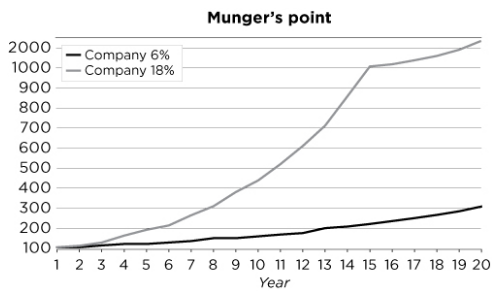

Charlie Munger has a very famous quote, that is a cornerstone of a 100-bagger philosophy:

Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return, even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result.

Below, we can see the dramatic difference between a 6% return and 18% return.

We will start discussing the other most important principles now

1. You have to look for them

- Don’t waste limited mental bandwidth on stocks that might pay a good yield or that might rise 30% or 50%. You only have so much time and so many resources to devote to stock research. Focus your efforts on the big game: The 100 baggers.

2. Value Added Growth

- We needs lots of growth and it should be value added growth. You want to find a business that has lots of room to expand - it’s what drives those reinvestment opportunities.

- You want to focus both on growth in sales and earnings per share.

- There are a few exceptions though. Amazon and Comcast grew sales at high rate but did not show much in the way of reported earnings through the high growth phase.

- Earnings Vs Earnings Power

- Earnings are the reported numbers

- Earnings power reflects the ability of the stock to earn above-average rates of return on capital at above-average growth rates. It’s long term assessment of competitive strengths.

3. Lower Multiples are preferred

- Don’t pay stupid prices.

- We say Lower multiples are “preferred” because you can’t draw hard rules about any of this stuff. There are times when even 50 time earnings is a bargain. You have to balance the prices you pay against other factors

Principles 2 and 3 together are called the Twin Engines of a 100-Bagger

4. Economic Moats are a necessity

A moat, even a narrow moat is a necessity.

- Moats can take various forms :

- Strong Brand

- Switching Cost

- Network Effect

- Low Cost producer

- Size Advantage

- Moats are not permanent. Competitors can eventually figure out their way across.

- Moats in essence are a way for companies to fight mean reversion.

- Mean reversion does not affect all companies equally.

- True moats are rare and not so easy to identify all the time. So, look for clear signs of moats in a business.

Michael Mauboussin on Moats

You can read the original study here

- Some industries are better at creating value than others.

- Even best industries include companies that destroy values and the worst industries have companies that create value. Some companies buck the economics of their industry provides insight into the potential sources of economic performance.

- Creating an industry map is a good idea. This details all players that touch an industry.

- Example: Airline Industry map would include aircraft lessor (Air Lease), manufacturers (Boeing), parts suppliers (B/E Aerospace) and more.

- This shows where the profit in an industry winds up and where you might focus your energies.

- Stable Industries are more conducive to sustainable value creation. E.g. Beverage Industry. Smart phones on the other hand are very unstable market.

Mean Reversion study by Matthew Berry

His study covers the 15 years from 1990 to 2004 and it includes 4000 largest companies primarily located in the US, UK, Canada, Germany, France, Italy and Spain.

- Mean reversion does not affect all companies equally.

- High Performer companies have many attributes in common

- High Return on Invested Capital (ROIC)

- High Gross margins are the most important signal of long run performance.

- If Gross Margins are sticky and persistent, then a good turnaround candidate would be one with a high gross profit margin and a low operating margin. The latter is easier to fix than the former.

- Big Companies tend to cement their advantage. “Larger companies appear able to sustain returns for longer by finding efficiencies in SG&A that small companies cannot”

- Scale and track record are also useful indicators. Winners tend to remain winners

5. Smaller Companies are preferred

- Start with acorns, wind up with oak trees.

- Median sales figure of 170 million$ makes for a substantial business in any era.

- As a general rule, look for companies with market caps less than 1 billion $.

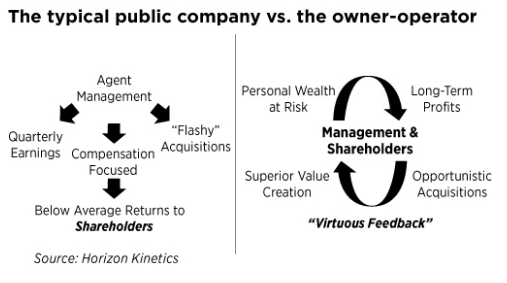

6. Owner-Operators Preferred

- For a stock to get in the fund, management must maintain a significant vested interest.

-

By virtue of owner-operator’s significant personal capital being at risk, he or she enjoys greater freedom of action and an enhanced ability to foucs on buidling long-term business value.

- Owner-Operators are opportunistic, tax efficient. E.g. Carl Icachn, John Malone at Liberty Media

- S&P uses float adjusted market cap to determine weight in the index. It’s also called free-float market cap. With stock buyback , the free-float goes down and so does the weight in the index.

- Many of the best-performing stocks of the past 50 years had such a key figure for at least part of their history.

Below images shows the “Virtous Feedback” created by Owner-Operators

Some great ideas from the outstanding book : Outsiders

- All CEO’s were great capital allocators, or great investors

- They also have 3 ways to raise money:

- Issue stock, issue debt, or tap the cash flow of the business

- Over the longer terms, returns for shareholders will be determined largely by the decision the CEO makes in choosing which tools to use.

- They also have 3 ways to raise money:

- Capital allocation is the CEO’s most important job.

- Value per share is what counts, not overall size or growth.

- Cash flow, not earnings , determines value;

- Decentralized organizations release entrepreneurial energies.

- Independent thinking is essential to long-term success.

- Sometimes the best opportunity is holding your stock.

- Patience is a virtue with acquisitions, as is occasional boldness.

Kelly’s Heroes : Bet Big

- Many great investors intuitively bet big on their best ideas.

7. You Need Time: Use the Coffee-Can Approach as a Crutch

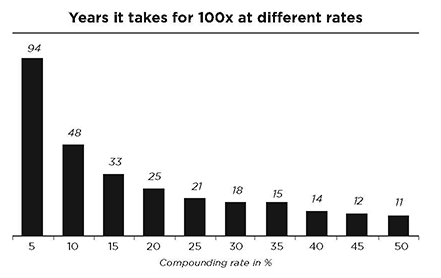

Once you do all the work to find a 100 bagger, you need to give it time. Even the fastest 100 baggers in the book’s study needed 5 years.

Knowing this, You need to find a way to defeat your own worst instincts- the impatience, the need for “action”, the powerful feeling that you need to “do something”. The Coffee-Can technique is a great idea and the genius of the technique lies in its ‘simplicity’.

Coffee-Can Portfolio

- The idea is simple : you find the best stocks you can and let them sit for 10 years.

- The essence of the coffee-can idea is really that it’s a way to protect you against yourself- from the emotions and volatility that make you buy or sell at the wrong times.

- Two important takeaways are:

- You must pick a compelling stock, ideally an established company with years of growth ahead and ability to compound at a high rate.

- Overall coffee-can portfolio returns can more than makeup for losing positions.

8. You Need a Really Good Filter

There is a world of noise out there. Everyday something important happens, or so the Media would like you believe.

- Stock prices fall for all different kind of reasons. Stocks sometimes make huge up/down moves and yet the business itself changes more slowly with time.

- Don’t fret so much with guesses as to where the stock market might go. Keep looking for great ideas. If history is any guide, they are always out there.

9. Luck Helps

There is an element of good luck/bad luck in our lives as well as in stock markets.

There is a great quote by Nicholas Rescher on chance,luck in his book : The Brilliant Randomness of Everyday life:

To be sure, given our natural human commitment to the idea that we live in a rational world, we are inclined to think that there is always an ultimate reason. ... All of this is perfectly natural but also totally futile.

The only ultimate rational attitude is to sit loosely in the saddle of life and come to terms with the idea of chance as such.

10. You Should Be a Reluctant Seller

In his book ‘Common Stocks and Uncommon Profits’, Phil Fischer mentions : “If the job has been done correctly when a common stock is purchased, the time to sell it is - almost never”

In book ‘100 to 1 in the Stock Market’, Thomas Phelps gave a selling advice ‘Never if you can help it take an investment action for a non-investment reason.’

Some of the ‘non-investment reasons’ include:

- My stock is “too high”

- I need the realized capital gain to offset realized capital losses for tax purpose

- My stock is not moving. Others are

The reasons to sell can be :

- You’ve made a mistake - that is, ‘the factual background of the particular company is less favorable than originally believed’

- The stock no longer meets your investment criteria.

- You want to switch into something better- although an investor should be careful here and only switch if “very sure of his ground”

Leave a Comment